Shares of multinational investment banking and financial services provider JPMorgan Chase & Co. (JPM) closed 1.7% lower on Tuesday and slid another 0.05% in after-hours trading despite the company reporting better-than-expected second-quarter financial results.

Quarterly earnings stood at $3.78 per share, up from $1.38 reported in the year-ago quarter. EPS beat the Street’s estimates of $3.20. (See JPMorgan stock chart on TipRanks)

Net revenue grew $30.5 billion and surpassed analysts’ expectations of $29.96 billion. However, the figure was less than $33.1 billion reported in the same quarter last year.

Consumer & Community Banking net revenue increased 3% year-over-year to $12.8 billion, net revenue of Commercial Banking rose 3% to $2.5 billion and Asset & Wealth Management net revenue was up 20% to $4.1 billion.

Meanwhile, Corporate & Investment Banking revenue fell 19% to $13.2 billion, and Corporate net loss stood at $1.2 billion. The company had reported a net loss of $754 million in the second quarter of 2020.

The CEO and Chairman of JPMorgan, Jamie Dimon, said, “Our longstanding capital hierarchy remains the same – first and foremost, to invest in and grow our market-leading businesses to support our clients, customers and communities – even in the most difficult of times, second, to pay a sustainable dividend which we have already announced we are increasing, and third, to return any remaining excess capital to shareholders through share buybacks which we plan to continue under our existing authorization.”

Last week, KBW analyst David Konrad initiated coverage on the stock with a Hold rating and a price target of $167 (7.3% upside potential). In a research note to investors, the analyst said that the company was trading at historical highs.

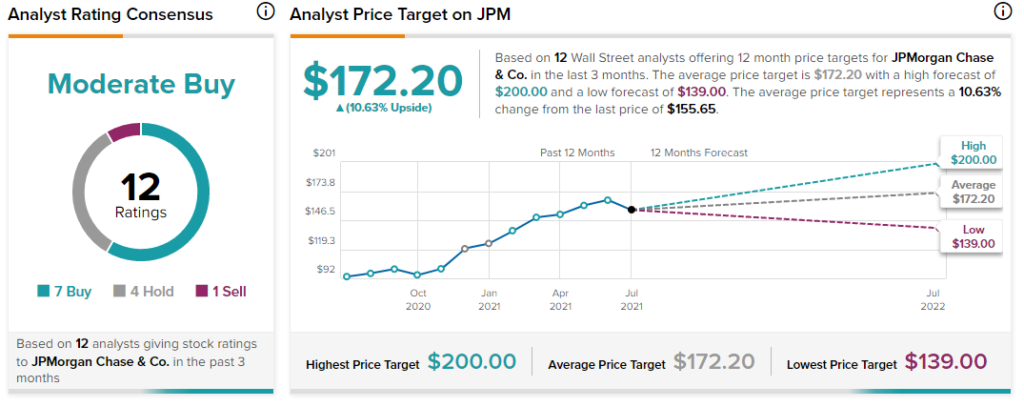

Overall, the stock has a Moderate Buy consensus based on 7 Buys, 4 Holds and 1 Sell. The average JPMorgan Chase price target of $172.20 implies 10.6% upside potential. The company’s shares have gained 58.5% over the past year.

Related News:

Middleby Snaps up Novy, Shares Rise

IAA Expands Payment Offerings for U.K. Buyers

What Do B2Digital’s Risk Factors Tell Investors?