J.P. Morgan Chase & Co. (JPM), a commercial and investment banking giant, announced to have launched a digital bill payment product, powered by Paymentus (PAY). Following the news, shares of the company rose 1.4% on Friday.

The new solution will equip customers with a single, modern platform for customer engagement, bill presentment and payments.

As of December 2020, Paymentus’ omnichannel, unified and highly configurable solution was being availed by 16 million customers and businesses (from local municipalities to Fortune 50 companies). (See J.P. Morgan stock charts on TipRanks)

The Global Head of Payments & Commerce Solutions at J.P. Morgan, Max Neukirchen, said, “Our clients expect us to provide modern capabilities and integrated solutions and with Paymentus, we’re uniting a leading, innovative FinTech platform with the #1 payments processing provider in the U.S.”

“Digital Bill Payment will help clients accelerate revenue realization, reduce costs to serve their customers, and improve user satisfaction through convenient and intuitive interactions,” Neukirchen added. (See Insiders’ Hot Stocks on TipRanks)

Following the Q3 earnings release, BMO Capital analyst James Fotheringham maintained a Hold rating on J.P. Morgan and raised the price target to $140 from $139. The new price target implies 18.5% downside potential.

The analyst is of the opinion that though credit is pristine, NPA formations post-stimulus remain worrisome. Also, re-regulatory agendas of new regulators might challenge earnings and share count forecasts.

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 8 Buys, 2 Holds and 2 Sells. The average J.P. Morgan price target of $171.33 implies 0.3% downside potential.

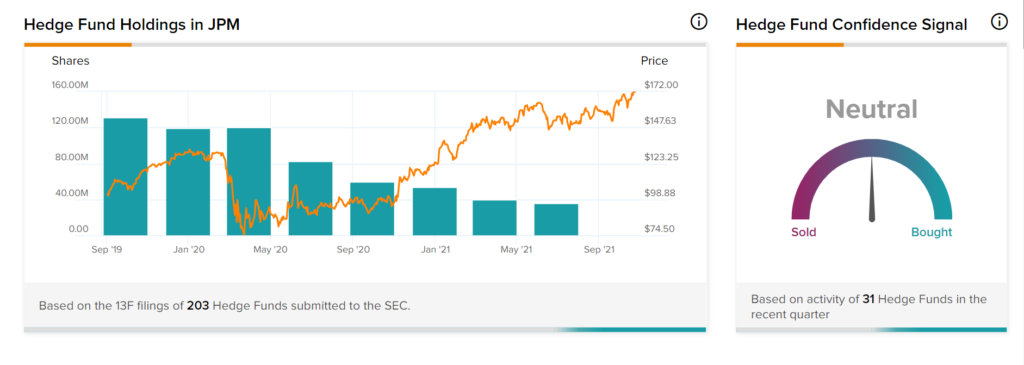

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in J.P. Morgan is currently Neutral, as the cumulative change in holdings across all 31 hedge funds that were active in the last quarter was a decrease of 3.3 million shares.

Related News:

Procore Acquires LaborChart; Street Says Buy

Freeport-McMoRan Delivers Mixed Q3 Results; Shares Drop

Cleveland-Cliffs Posts Strong Q3 Results; Shares Pop 4%