ITT Corp’s shares surged 2% on Feb. 19 as the global multi-industrial company’s fourth quarter results surpassed analysts’ expectations. Prudent cost management, benefit from the productivity, and restructuring cost savings were the primary drivers.

ITT’s (ITT) 4Q adjusted earnings inched up 2% to $1.01 per share on a year-over-year basis and beat the Street estimates of $0.92 per share. Adjusted revenues declined 3.9% to $708.6 million, but outpaced analysts’ expectations of $656.97 million.

The company’s motion technologies (MT) revenue increased 10% year-over-year to $352.1 million in the quarter, driven by a 13% rise in friction sales volumes. The adjusted segment operating margin was 16.9%, up 150 basis points.

ITT CEO Luca Savi commented, “We are well on track towards our 15% plus long-term margin target for Industrial Process. The strength of our portfolio and benefits from actions taken in 2020 will ensure ITT is well positioned for growth and margin expansion in 2021.”

For 2021, the company expects 2%-4% adjusted revenue growth. Adjusted EPS is anticipated to be in the range of $3.45 to $3.75, versus the consensus estimate of $3.60. The adjusted segment operating margin is projected to be 16.5%-17%. (See ITT stock analysis on TipRanks)

Concurrent with the earnings release, ITT also announced a 30% increase in its quarterly dividend to $0.22 per share. The new dividend will be paid on April 5 to shareholders of record as of March 17. The annual dividend of $0.88 per share now reflects a dividend yield of 1.12%.

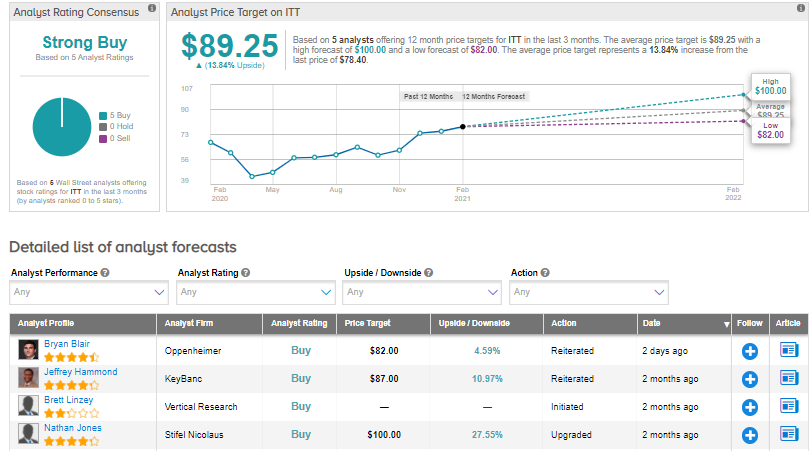

Following the 4Q results, Oppenheimer analyst Bryan Blair reiterated a Buy rating and a price target of $82 (4.6% upside potential) on the stock based on “continued strong execution from the ITT team.”

Blair believes “MT’s robust 4Q performance and underlying market rebound bode well for the high end of 2021 guidance.”

ITT shares have exploded almost 63% over the past six months, while the stock still scores a Strong Buy consensus rating based on 5 unanimous Buys. That’s alongside an average analyst price target of $89.25, which implies around 13.9% upside potential over the next 12 months.

Related News:

NiSource Outperforms 4Q Earnings Estimates, Misses On Revenues

Q2 Holdings’ 1Q Sales Outlook Exceeds Street Estimates; Street Is Bullish

Shopify’s 4Q Sales Pop 94% As Online Buying Booms; Shares Dip 3.3%