Nuclear power technology company Oklo Inc. (OKLO) is set to release its third-quarter 2025 financial results on Thursday, November 13, 2025. Analysts expect an earnings per share (EPS) loss of $0.14 for Q3, compared to the $0.08 per share loss reported in the same period last year. OKLO stock dropped about 14% over the past five trading days as investors sold shares ahead of the company’s earnings report. The stock rebounded slightly, gaining 4% in pre-market trading on Monday.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

While the company is still unprofitable, investor interest remains strong, driven by Oklo’s advanced nuclear reactor technology and its potential to power large-scale AI infrastructure. Year-to-date, OKLO stock has surged more than 430%.

What Investors Need to Watch

Last month, Oklo announced a strategic partnership with Newcleo and Blykalla to develop advanced fuel fabrication and manufacturing infrastructure in the U.S. Under the deal, Newcleo plans to invest up to $2 billion, while Blykalla will co-invest and source fuel-related services for the projects. Investors can expect further business updates to accompany the Q3 earnings release.

Oklo has not yet generated revenue, and its operating expenses for developing next-generation Aurora reactors are likely to keep quarterly losses high. Notably, the Aurora microreactor is a compact, advanced nuclear reactor designed to deliver clean, reliable, and scalable energy for various applications.

In September, Oklo made progress on its first Aurora powerhouse, breaking ground at Idaho National Laboratory (INL). However, the first reactor is not expected to be operational until late 2027, which means near-term revenue growth will be limited.

Insights from TipRanks’ Bulls Say, Bears Say

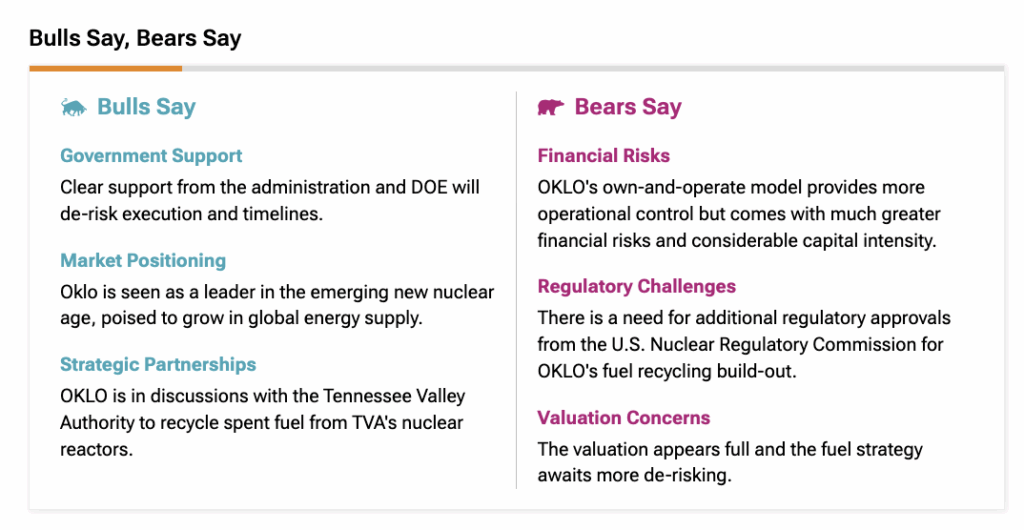

Ahead of Q3 earnings, analysts maintain a moderately bullish stance on OKLO stock. Investors can utilize TipRanks’ “Bulls Say, Bears Say” tool to gain insights into the contrasting analysts’ views on Oklo’s stock.

According to bullish analysts, Oklo benefits from strong government support, including backing from the administration and the DOE, which helps de-risk project execution and timelines. Additionally, Oklo is positioned as a leader in the emerging new nuclear sector, with strong growth potential in the global energy market. While the company has not yet launched a commercial product, it is making steady progress toward commercial operations. For investors considering exposure to the advanced nuclear space, Oklo presents a high-risk, high-reward opportunity.

On the other hand, bears are concerned that Oklo’s own-and-operate model, while giving operational control, carries high financial risk and significant capital requirements. The company also faces regulatory hurdles, needing additional approvals from the U.S. Nuclear Regulatory Commission for its fuel recycling plans.

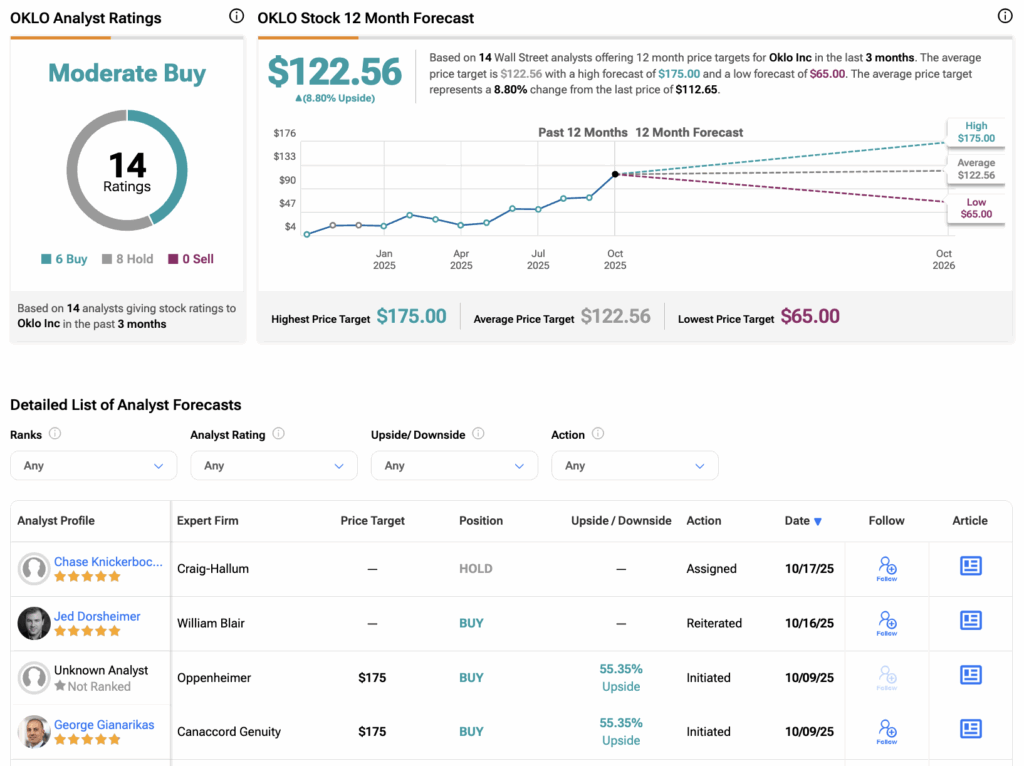

Is OKLO a Good Stock to Buy?

Overall, Wall Street has a Moderate Buy consensus rating on OKLO stock, based on six Buys and eight Holds assigned in the last three months. The average share price target for Oklo is $122.56, which implies an upside of 8.80% from current levels.