Johnson & Johnson and Pfizer have been in the news for the development of potential vaccines for COVID-19. According to the latest update, Johnson & Johnson is planning to enroll up to 60,000 participants for the phase 3 study of its Ad26.COV2.S COVID-19 vaccine candidate, which is expected to commence in September.

Meanwhile, on August 20, Pfizer and German-biotech firm BioNTech announced favorable phase 1 trial results for their second potential COVID vaccine B2. The companies disclosed that the second vaccine candidate BNT162b2 or B2 had fewer side effects than the first one – BNT162b1 or B1.

We will focus on Johnson & Johnson and Pfizer’s recent performance and growth prospects and use TipRanks’ Stock Comparison tool to see which healthcare company offers a more compelling investment opportunity.

Johnson & Johnson (JNJ)

Johnson & Johnson is the largest healthcare company with a diversified business model that comprises its consumer, pharmaceutical and medical devices businesses. The Pharmaceutical segment accounted for 51% of overall sales in 2019, while Medical Devices and Consumer segments contributed 32% and 17%.

JNJ has not been immune to the pandemic. The Medical Devices segment saw a 33.9% drop in the second-quarter sales as consumers postponed elective procedures. The Consumer segment’s sales fell 7.0% as the demand for over-the-counter products like Tylenol was more than offset by the impact of COVID-19 on sales of skin health and beauty care products.

The Pharmaceutical segment’s sales rose 2.1% driven by higher demand for certain drugs like immunology drug Stelara and multiple myeloma drug Darzalex. However, the pandemic and biosimilars and generic competition dragged down sales of certain drugs, including Remicade, Velcade and Zytiga.

Overall, JNJ’s sales declined 10.8% to $18.3 billion and adjusted EPS fell 35.3% Y/Y to $1.67 in the second quarter.

One of the major concerns for JNJ is the competition from generic drugs and biosimilars, especially for cancer medicine Zytiga, multiple myeloma drug Velcade, blockbuster immunology drug Remicade, and bone marrow stimulating drug Procrit.

However, momentum in immunology drugs Stelara and Tremfya and cancer drugs Darzalex and Imbruvica is helping offset the weakness in the aforementioned drugs. Meanwhile, JNJ’s pharmaceutical business has a strong pipeline with over 30 drugs in late-stage development.

JNJ is strengthening its autoimmune portfolio with the recently announced acquisition of biotechnology company Momenta Pharmaceuticals for $6.5 billion. The deal will help the company expand its presence in the autoimmune disease treatments through Momenta’s anti-FcRn antibody- nipocalimab (M281) and other assets.

Following the news of Momenta’s potential acquisition, Credit Suisse analyst Matt Miksic reiterated a Buy rating for JNJ with $163 price target. Miksic stated, “Management sees the potential for nipocalimab (anti-FcRn antibody) alone to produce multiple launches, many as potentially first-in-class indications and some potentially with peak sales of >$1 bil.”

Despite litigations related to opioids and talc, several investors look toward JNJ stock for the growth prospects in its pharma business and its dividends. JNJ is a Dividend King and has increased its dividend for 58 consecutive years, including the 6.3% hike this year. It has a dividend yield of 2.65%. (See JNJ stock analysis on TipRanks)

The Street has a Strong Buy consensus for JNJ based on 7 back-to-back Buy ratings from analysts offering price targets in the last three months. JNJ stock has advanced about 5% so far in 2020 and a 12-month average price target of $166.86 implies a further upside potential of 9.23%.

Pfizer (PFE)

Pfizer stock underperformed the broader market in 2019 and it continues to lag this year. The company’s second-quarter revenue plunged 11% Y/Y to $11.8 billion as Upjohn sales declined 32% due to generic competition for Lyrica in the US.

Pfizer is spinning off Upjohn and merging it with Mylan. The transaction is expected to close this in the fourth quarter. The company decided to spin off the Upjohn unit, which sells off-patent drugs, to focus on its profitable higher-growth drugs.

The year-over-year decline in Pfizer’s second-quarter revenue also reflected the impact of the deconsolidation of the company’s Consumer Healthcare business following the formation of a joint venture with GlaxoSmithKline last year.

Pfizer’s Biopharma unit generated a 4% revenue growth in second quarter primarily due to the demand for its metastatic breast cancer med Ibrance, oncology drugs Inlyta and Xtandi, blood thinner treatment Eliquis (Pfizer co-markets it with Bristol Myers Squibb) and heart drugs Vyndaqel and Vyndamax.

The pandemic had a 4% adverse impact on the company’s revenue due to lower vaccinations and prescriptions filled in the US as well as a fall in demand for certain products in China. Pfizer’s second-quarter adjusted EPS declined 2.5% to $0.78.

A recent setback for the company was when an independent data monitory committee determined that a phase 3 study involving Ibrance for early breast cancer treatment was unlikely to meet the main goal.

As of July 28, Pfizer’s pipeline consisted of 90 drugs, including 23 in phase 3. The company is banking on biosimilars for certain blockbuster drugs to boost its top line.

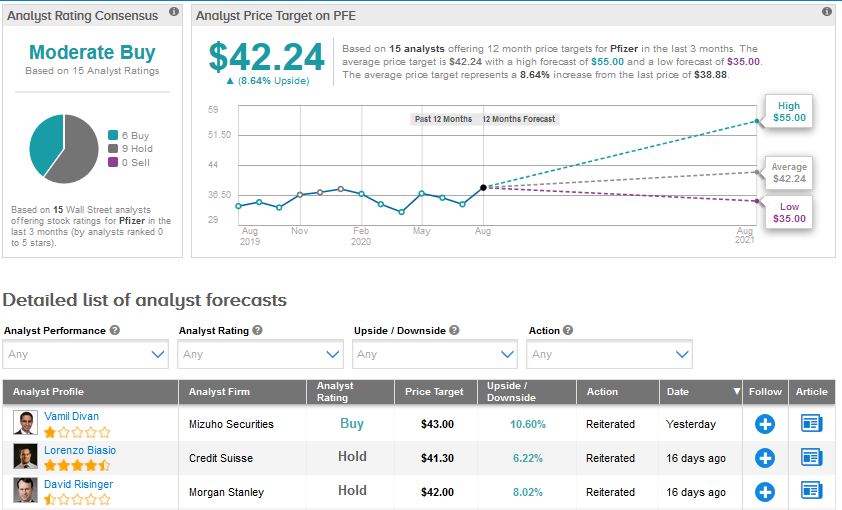

In reaction to the latest favorable news related to Pfizer and BioNTech’s second vaccine candidate BNT162b2, Mizuho Securities analyst Vamil Divan said, “Overall the data look encouraging, as the immunogenicity data for BNT162b2 looks comparable to those of BNT162b1, but the systemic safety profile was significantly milder, particularly in the 65+ year old patient group that is particularly at risk from significant complications from infection.”

Divan has a Buy rating for Pfizer stock with a price target of $43. (See PFE stock analysis on TipRanks)

In December 2019, Pfizer declared a 5.5% increase in its quarterly dividend per share to $0.38. The company has a dividend yield of 3.9%.

Wall Street has a cautiously optimistic Moderate Buy consensus for Pfizer that breaks down into 6 Buys and 9 Holds. Pfizer stock has declined 0.8% year-to-date. The average price target of $42.24 for Pfizer stock implies an upside potential of 8.64%.

Conclusion

Success in developing a COVID-19 vaccine will be a huge boost to the prospects of JNJ and Pfizer. But, right now Johnson & Johnson looks to be a better choice based on its strong diversified business model, better operating metrics, stronger cash flows, analyst optimism, and further upside potential in the stock.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment