ironSource Ltd. (IS) reported third-quarter results, with in-line earnings and revenues topping analyst expectations. IS, which is a business platform for the app economy, also raised its FY2021 guidance and provided a fourth-quarter outlook above analyst expectations.

Q3 Revenue Beat, EPS In-Line

The company’s revenues jumped 60% year-over-year to $140.4 million, exceeding consensus estimates of $129.37 million. It achieved a dollar-based net expansion rate of 170%, against an average of 157% in the previous ten quarters.

Similarly, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) margin expanded by 200 basis points (bps) to 36% during the quarter.

Meanwhile, adjusted earnings of $0.02 per share met analysts’ expectations. The company reported earnings of $0.03 per share in the prior-year period.

During the quarter, ironSource announced that it will acquire Tapjoy, and Bidalgo to accelerate its platform’s offering.

ironSource Raises FY2021 Outlook

Based on robust Q3 results, management raised the financial guidance for FY2021 and provided guidance for the fourth quarter.

For FY2021, revenues are forecast to grow 62% and be in the range of $535 million to $540 million, higher than the previous guidance range of $510 million to $520 million.

Furthermore, the company forecasts adjusted EBITDA to be in the range of $186 million to $188 million, exceeding the previous guidance range of $173 million to $178 million.

Revenues are expected to grow 32% for the fourth-quarter and be in the range of $140 million to $145 million, while the consensus estimate is pegged at $135.3 million. Adjusted EBITDA is projected to grow around 57% year-over-year and be in the range of $50 million to $52 million.

Management Weighs In

ironSource CEO, Tomer Bar Zeev, commented, “Our strong execution, despite the industry challenges around IDFA, is a tribute to our scale and technology advantage, and this growth is ultimately a testament to the strength of our platform-based approach to the App Economy.

He added, “Beyond strong organic growth, this approach has also driven our M&A strategy, with the announcement of two strategic acquisitions designed to deepen and expand our platform offering to increase our stickiness with customers.”

Wall Street’s Take

Following upbeat Q3 results, Oppenheimer analyst Martin Yang increased the price target on ironSource to $15 (23.76% upside potential) from $13, and reiterated a Buy rating.

Yang stated, “Looking into FY22, some near-term catalysts include expansion within both gaming and nongaming categories, integration of recent acquisitions, solidifying Aura partnerships in Europe, and launch of AuraTV.”

He added, “Given the initial uncertainties surrounding IDFA behind us, we feel confident that ironSource is well-positioned amongst peers to maintain its industry-leading growth and profitability.”

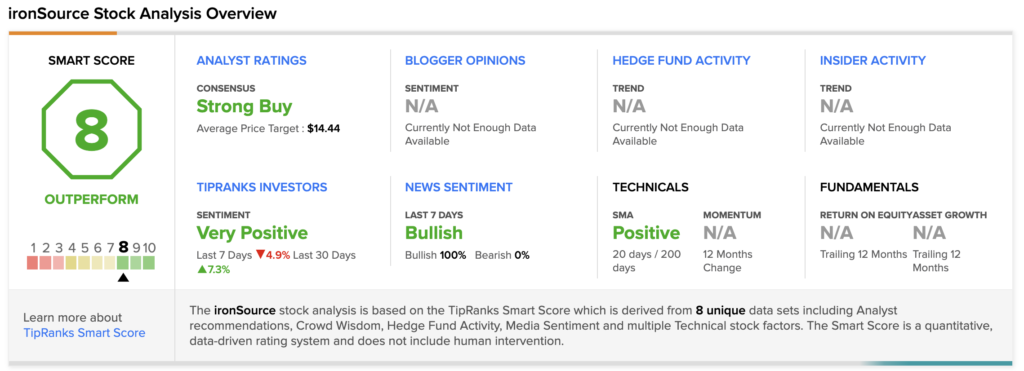

Consensus among analysts is a Strong Buy based on 9 Buys and 1 Hold. At the time of writing, the average ironSource price target was $14.44, which implies upside potential of 19.14% from current levels.

ironSource scores an 8 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock is likely to perform in line with market expectations. Shares have gained about 10.2% over the past year.

Related News:

DoorDash Up 19% on Wolt Acquisition and Q3 Revenue Beat

Repay Holdings Outperforms in Q3

Senseonics Holdings Exceeds Q3 Earnings Expectations