Shares of consumer robot company iRobot, Corp. (IRBT) have declined 45% over the past 12 months. IRBT’s product portfolio caters to the robot cleaning category and intelligent home solutions. It has sold over 40 million robots so far. IRBT’s recent fourth-quarter performance fell short of expectations on both its top-line and bottom-line fronts.

Revenue dropped 16.4% year-over-year to $455.4 million, missing estimates by $8.3 million. Net loss per share at $1.05 came in wider than the Street’s estimates by $0.11. Amid the present semiconductor chip challenges and shipping constraints, the company saw an impact on its ability to fulfill approximately more than $35 million in orders.

Nonetheless, during this period IRBT increased its connected customer base by 44%. Management noted the runway for robotic floor care remains robust and the company is in a position to take part in the global expansion of this category.

Looking ahead, for fiscal 2022, IRBT sees revenue landing between $1.75 billion and $1.85 billion. Earnings per share are expected to be in the range of $1.50 and $2. These expectations point to revenue growth of 1% to 18% and earnings per share expansion of 12% to 49%.

With these developments in mind, let us take a look at the changes in IRBT’s key risk factors that investors should know.

Risk Factors

According to the TipRanks Risk Factors tool, iRobot Corp’s top risk category is Tech & Innovation, contributing 8 of the total 36 risks identified for the stock, compared to a sector average of 3 risk factors under the same category.

However, in its recent report, the company has added one key risk factor under the Ability to Sell risk category.

IRBT highlighted that it has experienced supply chain challenges and longer lead times amid COVID-19-related higher demand, which has impacted cost and availability of transportation. Further, container bottlenecks at ports have meant an increase in the market cost of inbound freight by several multiples.

IRBT acknowledged that if these challenges persist, then its gross margins, delivery times, and ability to fulfill orders may suffer.

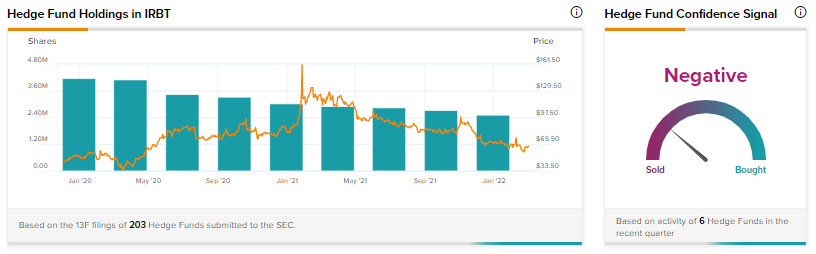

Hedge Fund Activity

According to TipRanks data, the Wall Street’s top hedge funds have decreased holdings in iRobot Corp by 194.3 thousand shares in the last quarter, indicating a negative hedge fund confidence signal in the stock based on activities of 6 hedge funds. Notably, Ray Dalio’s Bridgewater Associates has a holding worth $3.65 million in IRBT.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Nordstrom Gains 32% on Stellar Q4 Beat & Upbeat FY22 Outlook

Horizon Therapeutics Delivers Upbeat Results in Q4; Shares Up 6.5%

First Solar Drops 16% on Revenues Miss & Muted Outlook