Ralph Lauren (RL) released its quarterly earnings yesterday. The famed apparel and home-products company posted an operating loss of $283.8 million or 68 cents a share for the quarter ended March 28 on revenue of $1.27 billion. Analysts were forecasting a loss of just seven cents a share, on revenue of $1.29 billion.

Sales slid 15% last quarter compared with the prior year. One ray of light, however, was that while revenue declined in the high double-digit range in February at the peak of store closures in the country, by early May sales had rebounded.

CEO Patrice Jean Louis Louvet said that Ralph Lauren was suspending all financial forecasts, citing the uncertainty resulting from Covid-19. In its press release, the company said it expects financial results to be “significantly negatively impacted by the pandemic” in the current quarter, and in its fiscal 2021 year. Nevertheless, investors showed patience, with the company’s shares only dropping 0.6%.As is now common in the Covid-19 era, online sales were a bright spot, increasing by mid-single digits in the last quarter and nearly 10% for the year.

Ralph Lauren has made efforts in recent years to distinguish itself by not discounting, in order not to scratch the luster of its brand image and positioning. The average price per item sold in in the last quarter increased by a full 8% from last year, beyond what the company had guided towards on the previous earnings call.

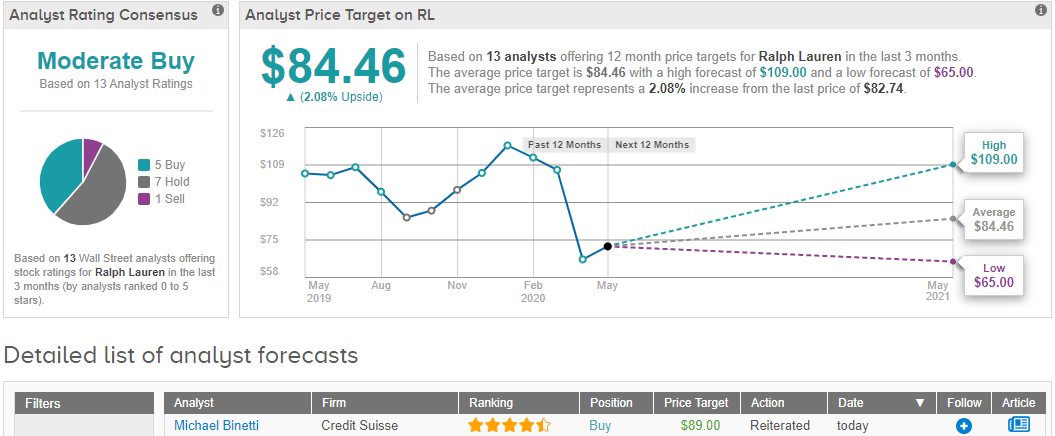

Rick Patel of Needham recently reiterated a Buy rating and $90 price target on Ralph Lauren, stating that given the recent pullback in price, it traded at an “attractive valuation.” He also observed that “RL has the balance sheet to endure the crisis, its recent expense reduction should help to partly offset the hit to margins, and inventory cuts should help to minimize markdowns and protect the brand.”

Ralph Lauren traded above $120 as recently as February; it closed yesterday at $81. TipRanks data shows a Moderate Buy consensus around AT&T stock among Wall Street analysts. An average analyst price target of $84 implies 2% upside potential in the shares in the coming 12 months. (See Ralph Lauren stock analysis on TipRanks).

Boeing CEO Says ‘Likely’ A Major Airline Could Fold In 2020

Weight Watchers Fires Thousands Over Zoom

Microsoft Seeks $2B Stake In India’s Jio Platforms- Report