Private sector investment in space exploration continues to increase as more companies become involved in areas such as rocket and shuttle technology. One such company pushing the bounds of the final frontier is AST SpaceMobile (ASTS), a newcomer to the nascent space industry. It is set to disrupt the telecommunications industry with its space-based satellites. Although still a high-risk investment, ASTS’s approach to satellite-based communication has the potential for substantial returns in the long term.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company is launching five Bluebird satellites in early September to enhance cellular connectivity in remote areas in collaboration with major telecommunication companies such as Verizon (VZ) and AT&T (T). It also aims to launch as many as six satellites a month by 2025. The stock rose sharply, climbing over 54% in the past week after the company announced the pending commercial deployment of its satellites. It is an intriguing option for investors interested in participating in high-risk, high-reward space-age communications.

AST’s Ecosystem Built for the Stars

AST SpaceMobile is a company that develops and provides access to space-based cellular broadband networks for smartphones in the U.S. Its first five commercial satellites are projected for a dedicated orbital launch in early September, making them the largest-ever communication arrays that will be commercially deployed in low Earth orbit.

The company has expanded the SpaceMobile commercial ecosystem by adding Verizon as an investor and customer, alongside AT&T. This encourages a national coverage target of approximately 100% in the continental U.S. on premium 850 MHZ low-band spectrum. Furthermore, the initial five satellites can offer U.S. nationwide non-continuous service, with over 5,600 cells in the premium low-band spectrum.

In terms of manufacturing, AST SpaceMobile reports approximately 95% vertical integration for satellite components and subsystem production, maintaining control over the 3,400 patents and patent-pending claims the firm has developed for the satellite manufacturing process. The satellites are manufactured at the company’s facilities in Texas, with the first five complete and the production of 17 more underway. The initial launch is targeted for Q1 of 2025.

ATST has grown its relationships with the U.S. Government via initial in-orbit testing and early-stage contract awards to one of its prime contractors. The firm has also seen successful initial in-orbit and ground tests for non-communications applications, which has resulted in completed contractual milestones and revenue. ATST has received an initial license for Space-Based operations in the U.S. from the FCC and anticipates additional U.S. Government contracts in the coming months.

Analysis of AST’s Recent Financial Results

The company recently reported financial results for Q2 2024. Revenue was $900,000, missing analysts’ expectations of $21 million. Non-GAAP adjusted cash operating expenses were $34.6 million, slightly up from $31.1 million in Q1, due to costs related to the completion of Block 1 satellites. Earnings per share (EPS) of -$0.51 fell short of analysts’ expectations of -$0.22.

As of the quarter’s end, ATST’s held cash and cash equivalents and restricted cash, amounting to $287.6 million. They also reported an additional $51.5 million as liquidity available to pull from the Senior Secured Credit Facility, subject to certain approvals and conditions.

What Is the Price Target for ASTS Stock?

The stock has been rocketing, climbing over 695% in the past year. It trades at the high end of its 52-week price range of $1.97 – $36.87 and shows ongoing positive price momentum, trading above its 20-day (20.63) and 50-day (15.66) moving averages. However, it has been volatile, with the stock’s beta at 2.08.

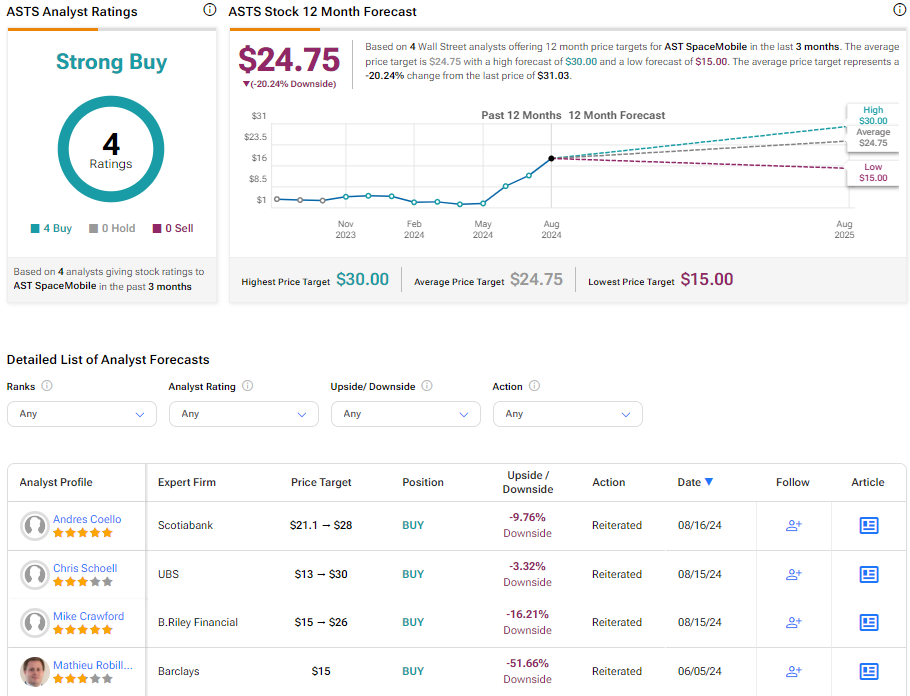

Analysts following the company have been bullish on the stock. For instance, Scotiabank analyst Andres Coello, a five-star analyst according to Tipranks’ ratings, recently raised the price target on the shares from $21.10 to $28 while maintaining an Outperform rating, noting the company could find itself as the sole licensed spacecraft control system in the world’s wealthiest telecom market.

AST SpaceMobile is rated a Strong Buy based on four analysts’ cumulative recommendations and recently assigned price targets. The average price target for ASTS stock is $24.75, representing a potential -20.24% change from current levels. However, given recent developments, I suspect further price-target revisions will be forthcoming, increasing the average price target.

Final Analysis on ASTS

AST SpaceMobile’s innovative approach to satellite-based communication offers a compelling investment opportunity with significant long-term potential. With robust partnerships and an extensive patent portfolio, AST SpaceMobile has positioned itself at the heart of technological advancement and commercial viability. However, potential investors should consider the inherent risks associated with the space industry, not least of which are regulatory hurdles and unpredictable financial results.

ASTS’s dynamism offers a compelling proposition for risk-tolerant investors looking to capitalize on the frontier of space-age communications.