Financial technology platform Intuit Inc. (INTU) recently announced that it has agreed to acquire marketing automation platform Mailchimp for about $12 billion. The deal is likely to close before the end of Intuit’s second-quarter fiscal 2022.

Following the news, shares of the company appreciated marginally to close at $560 in extended trade on Monday.

Intuit’s aim to gain a strong foothold in the small business management space is expected to receive a boost with this buyout. With Mailchimp in its portfolio, Intuit will look to cater to all the pressing needs of a small business ranging from marketing, customer relationships and data analytics to accessing capital, paying employees and managing cash flows. Also, Mailchimp’s global presence of 13 million users and 70 billion contacts is expected to serve Intuit well.

Notably, Intuit expects the deal to be accretive to its earnings per share for full-year fiscal 2022. Further, the total consideration of $12 billion includes about $300 million of assumed Mailchimp employee transaction bonuses that will be issued in the form of restricted stock units, expensed over three years. The remainder of the consideration will be paid in cash and stock equally with the shares of Intuit common stock being valued at $562.61 per share. The company expects the cash part of the transaction to be funded by cash in hand and new debt of approximately $4.5 billion to $5 billion.

The CEO of Intuit, Sasan Goodarzi, said, “Together, Mailchimp and QuickBooks will help solve small and mid-market businesses’ biggest barriers to growth, getting and retaining customers. Adding Mailchimp furthers our vision to provide an end-to-end customer growth platform to help our customers grow and run their businesses, putting the power of data in their hands to thrive.” (See Intuit stock chart on TipRanks)

On September 13, Jefferies analyst Brent Thill reiterated a Buy rating on the stock with a price target of $640, which implies upside potential of 14.8% from current levels.

According to the analyst, the company’s acquisition of Mailchimp is expected to bode well, as it completes Intuit’s vision of bringing an end-to-end platform to its customers.

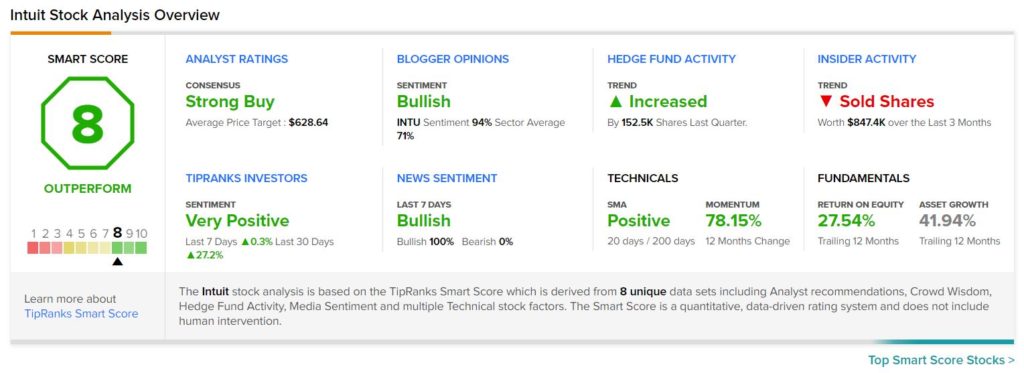

Consensus among analysts is a Strong Buy based on 13 Buys and 1 Hold. The average Intuit price target of $628.64 implies upside potential of 12.8% from current levels.

Intuit scores an 8 out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations. Shares have gained 75.1% over the past year.

Related News:

Stanley Black & Decker to Snap Up Excel Industries for $375M

KKR to Sell Texas Office Campus for Over $300M

Caterpillar Acquires CarbonPoint Solutions