To attract individual investors, automated global electronic market maker and broker Interactive Brokers (IBKR) has launched a simple flat fee structure for stock trading in Europe.

The new model will be made available at the exchanges in Western Europe. A similarly pricing structure for Central European and Nordic markets is on the cards.

Interactive Brokers will be pricing trades up to 6,000 EUR/GBP in value at 3 EUR/GBP. Also, commissions for larger trades will be 0.05% of trade value. New commission rates will be available with IB SmartRouting℠. (See Interactive Brokers stock chart on TipRanks)

Recently, Jefferies analyst Daniel Fannon maintained a Buy rating on the stock and decreased price target to $80 from $89. The new price target implies 27% upside potential from current levels.

Fannon noted, “The backdrop remains constructive as trading begins to normalize, margin balances remain at or close to record-highs, along with a positive beta tailwind.” The analyst is of the opinion that earnings power could still improve as client activity normalizes and interest rates begin to move higher.

Based on 3 Buys, 1 Hold and 1 Sell, the stock has a Moderate Buy consensus. The average Interactive Brokers analyst price target of $86 implies 36.6% upside potential from current levels.

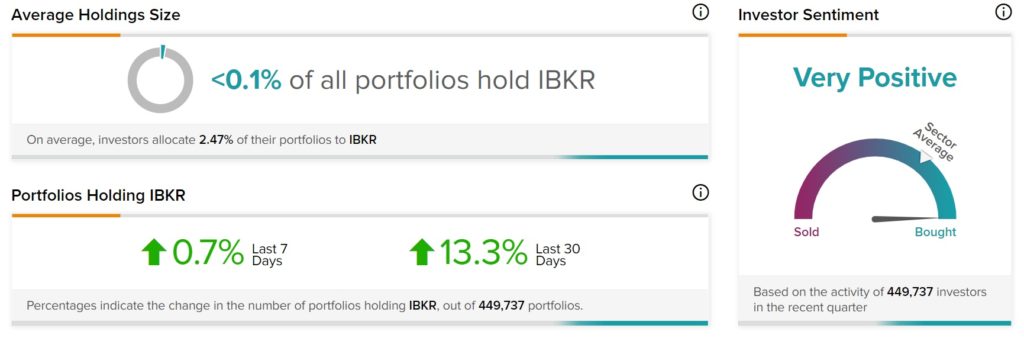

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Interactive Brokers, with 13.3% of investors, who have their portfolio on TipRanks, increasing their exposure to IBKR over the past 30 days.

Related News:

Verizon & Ericsson Strike $8.3B 5G Deal

Western Alliance Reports Upbeat Q2 Results; Street Says Buy

Truist Financial Q2 Earnings Surpass Expectations