In a bit of an unexpected development, chip stock Intel (NASDAQ:INTC) is down fractionally in Friday morning’s trading session after the EU’s antitrust operations socked it with a $400 million fine. This came despite the fact that Intel already seemed to have won that fight last year.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Back in 2009, Intel got hit with a 1.06 billion euro fine, thanks to the European court’s conclusion that Intel was using illegal tactics to shut AMD (NASDAQ:AMD) out of the European market. Back in early 2022, however, a different European court shut down that fine, which should have been the end of it. However, it was not the end of it, as the General Court in the EU annulled the first decision but found that there was still an “abuse of Intel’s dominant market position” to consider. But now, the total fine needed to be adjusted instead, and we arrived here at $400 million.

Meanwhile, some analysts believe that Intel has a bigger problem than AMD in Nvidia (NASDAQ:NVDA). Nvidia has a pronounced lead in the artificial intelligence market, which is likely to be a much bigger market than the regular PC market for some time to come. Intel did roll out some developments in that direction from its latest Innovation event, but Nvidia’s lead is, after all, pronounced. Intel’s ability to catch up while maintaining its current business is sparking skepticism and, thus, limiting its overall future.

Is Intel a Buy, Hold, or Sell?

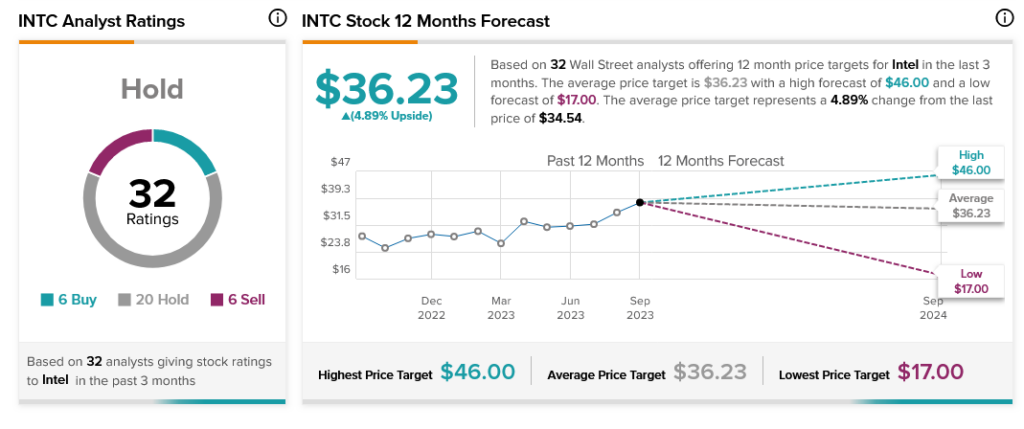

Indeed, analysts are skeptical. A combination of six Buy ratings, six Sell ratings, and 20 Hold ratings make Intel stock a clear Hold by analyst consensus. Further, with an average price target of $36.23, Intel stock offers a modest 4.89% upside potential.