Chipmaker Intel Corporation (NASDAQ: INTC) has revealed the appointment of David Zinsner as the company’s EVP and Chief Financial Officer (CFO), effective January 17, 2022. Notably, with over 20 years of financial and operational experience in semiconductors and manufacturing, Zinsner most recently served as an EVP and CFO at Micron Technology, Inc. (MU).

Following the news, shares of the world’s largest semiconductor chip manufacturer by revenue rose 3% in the extended trading session after closing 3.3% higher on Monday.

Current CFO George Davis will retire from Intel in May 2022 and will serve as an advisor until then to ensure a smooth transition.

Zinsner will report to Intel CEO Pat Gelsinger and head Intel’s global finance organization, including finance, accounting and reporting, tax, treasury, internal audit, and investor relations. Prior to his role at Micron, Zinsner served in finance positions at Affirmed Networks and Analog Devices (ADI).

CEO Comments

Gelsinger commented, “Dave is a proven finance leader, who brings a unique combination of strategic thought, deep knowledge of semiconductors and manufacturing, capital allocation discipline, and a track record of value creation for shareholders. I look forward to partnering with Dave as we continue to execute our strategy to usher in a new era of innovation and achieve our goal of unquestioned leadership in every category in which we compete.”

Other Developments

Intel announced the appointment of Michelle Johnston Holthaus as head of the company’s Client Computing Group (CCG). Currently, she is serving as EVP and general manager of the Sales, Marketing, and Communications Group.

Gelsinger said, “Michelle’s track record of success driving global sales and revenue for the last five years, combined with her profound understanding of the client computing business and trusted relationships across the entire industry, make her a natural choice to lead our largest business.”

Wall Street’s Take

Yesterday, Bank of America Securities analyst Vivek Arya maintained a Sell rating on Intel but raised the price target to $55 from $50.

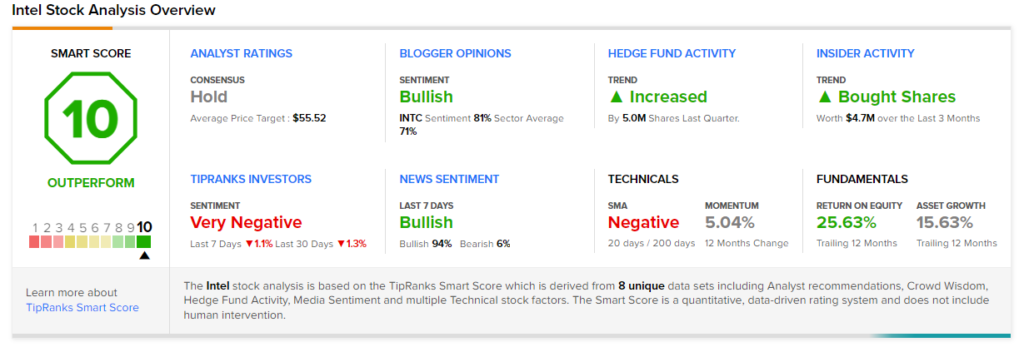

Overall, the stock has a Hold consensus rating based on 6 Buys, 11 Holds, and 7 Sells. The average Intel price target of $55.52 implies that shares are fully valued at current levels. Shares have gained 6.4% over the past year.

Smart Score

Intel scores a “Perfect 10” from TipRanks’ Smart Score rating system. This makes it one of TipRanks’ Top Stocks and implies that the stock has strong potential to outperform market expectations.

Download the TipRanks mobile app now

Read full Disclaimer & Disclosure

Related News:

Take-Two to Acquire Zynga for $12.7B

Ocugen Reveals Positive Results from Phase 2 Analysis of COVAXIN

FedEx Operations Affected by Omicron & Bad Weather – Report