Intel Corp. (INTC) has agreed to acquire Israel-based Granulate Cloud Solutions. Granulate develops real-time continuous optimization software, which helps obtain greater performance and return on investment in cloud and data centers. The transaction terms remained undisclosed.

The move is expected to enable cloud and data center customers in maximizing compute workload performance, while reducing infrastructure and cloud costs.

Management Weighs In

Executive Vice President and General Manager of the Datacenter and AI Group at Intel, Sandra Rivera, commented, “Granulate’s cutting-edge autonomous optimization software can be applied to production workloads without requiring the customer to make changes to its code, driving optimized hardware and software value for every cloud and data center customer.”

CTO, Senior Vice President, and General manager of the Software and Advanced Technology Group at Intel, Greg Lavender, added, “Granulate’s innovative approach to real-time optimization software complements Intel’s existing capabilities by helping customers realize performance gains, cloud cost reductions, and continual workload learning.”

Notably, Granulate’s service does not necessitate intervention by developers or customers making changes to its own code. Granulate was a part of Intel’s startup accelerator program, and the two companies have collaborated on workload optimization on Xeon deployments.

The collaboration resulted in better performance and lower costs for customers using Intel processors. The acquisition is expected to close in Q2 2022.

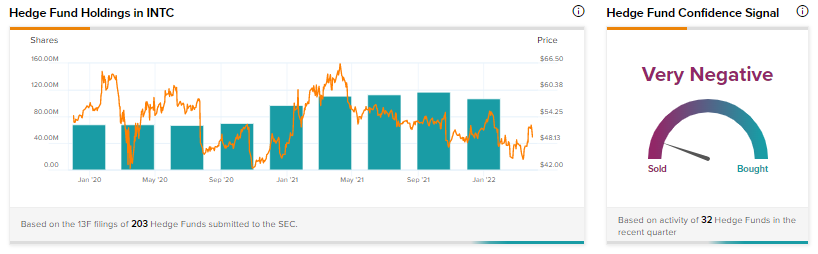

Hedge Fund Activity

TipRanks data points that Wall Street’s top hedge funds have decreased holdings in Intel by 10.1 million shares in the last quarter, indicating a very negative hedge fund confidence signal in the stock based on activities of 32 hedge funds.

Valuation Speaks

Let us consider some key metrics for Intel and how it fares against the broader industry. The company’s earnings before interest, taxes, depreciation and amortization (EBITDA) margin of 42.9% far outperforms the industry median of 13.8%.

Further, a return on total assets of 11.8% implies Intel is more efficient at putting its assets to work than the broader industry, where the median figure is 3.6%.

Finally, the company has a net income per employee of $164,060, which is over 15x than the industry median of $9,797. Shares are up 5.9% over the past month.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Citi’s India Divestment Plan Takes Shape

BioNTech’s Q4 Earnings Impress Investors

Will DTE and Lyft Partnership Benefit EV Drivers?