Cloudflare (NET) is an American web infrastructure and website security solutions provider. The California-based company was founded in 2009.

To expand its security business, Cloudflare has agreed to acquire Area 1 Security. This follows its recent acquisition of Vectrix. Area 1 helps secure corporate emails against phishing attacks and other threats. Vectrix, on the other hand, helps security teams detect and address issues such as user permission misconfigurations and inappropriate file sharing.

For Q4 2021, Cloudflare reported a 54% year-over-year rise in revenue to $193.6 million and exceeded the consensus estimate of 184.9 million. It posted adjusted net income of $0.1 million, which improved from a loss of $7.4 million. Cloudflare ended the quarter with more than $1.8 billion in cash.

With this in mind, we used TipRanks to take a look at the risk factors for Cloudflare.

Risk Factors

According to the new TipRanks Risk Factors tool, Cloudflare’s top risk category is Finance and Corporate, with 33 of the total 79 risks identified for the stock. Tech and Innovation and Ability to Sell are the next two major risk categories with 13 risks each. Here are the takeaways from Cloudflare’s risk factors.

The company tells investors that its reported financial results may be significantly impacted by how it accounts for convertible debt securities.

Cloudflare tells investors that the growth of its business depends on its relationship with third parties. It cautions that failure to retain or expand these relationships may adversely impact its operating results and financial condition. The company explains that many of its strategic partners have chosen short-term contractual arrangements that could be terminated at short notice. Further, the company explains that increasing competition could make retaining or expanding strategic partner relationships difficult.

Finally, Cloudflare cautions that its security products may fail to perform as intended. The company explains that the Russia-Ukraine conflict could increase cyberattacks targeted at its customers. While Cloudflare’s security products are designed to protect against malware and other security threats, the company says that no security solution can address all possible threats. If its security products fail to protect customers as intended, Cloudflare warns that its business, operating results, and reputation may suffer.

Analysts’ Take

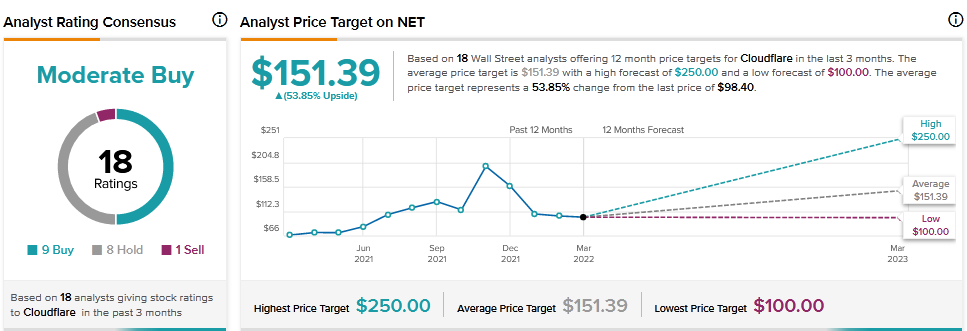

JMP Securities analyst Trevor J. Walsh initiated coverage of Cloudflare stock with a Buy rating and a price target of $175, which implies 77.85% upside potential.

Consensus among analysts is a Moderate Buy based on 9 Buys, 8 Holds, and 1 Sell. The average Cloudflare price target of $151.39 implies 53.85% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

E.U. to Approve Amazon’s MGM Buy Unconditionally – Report

CIBC Named One of Canada’s Best Diversity Employers

TD Bank Discloses 2030 Interim Financed Emissions Targets