Bentley Systems (BSY) is an American infrastructure engineering software provider. It serves engineers, architects, and constructors, offering solutions for design, construction, and infrastructure operations.

Bentley recently acquired Power Line Systems, a provider of software used in the design of overhead electric power transmission lines. It spent $700 million cash on the acquisition.

For Q4 2021, Bentley reported a 21.9% year-over-year jump in revenue to $267.7 million and surpassed the consensus estimate of $262.8 million. It posted adjusted EPS of $0.23, which rose from $0.17 in the same quarter the previous year and beat the consensus estimate of $0.17.

Bentley ended the quarter with $329.3 million in cash. It plans to distribute a quarterly dividend of $0.03 per share on March 15 to shareholders of record on March 8.

With this in mind, we used TipRanks to take a look at the newly added risk factors for Bentley.

Risk Factors

According to the new TipRanks Risk Factors tool, Bentley Systems’ main risk category is Finance and Corporate, with 16 of the total 40 risks identified for the stock. Macro and Political and Tech and Innovation are the next two major risk categories with 7 and 6 risks, respectively. Bentley has recently updated its profile with four new risk factors.

The company tells investors that the Bentley Control Group controls the majority of voting shares in the company. Therefore, the group is able to influence matters that require shareholder approval. The company cautions that since the group’s interests may differ from those of other shareholders, it may vote in a way that may be harmful to the interests of the other shareholders.

Bentley tells investors that it is required to evaluate the effectiveness of its internal controls over financial reporting. It cautions that if material weaknesses are discovered in its internal controls, investors may lose confidence in the completeness and accuracy of its financial results, which could adversely affect the company’s business and stock price.

In another newly added risk factor, Bentley informs investors that it makes certain estimates and assumptions when preparing its financial statements. The estimates and assumptions include revenue recognition and the fair value of acquired assets. The company cautions that the actual results may differ materially from its estimates and that such differences could impact its financial results.

Analysts’ Take

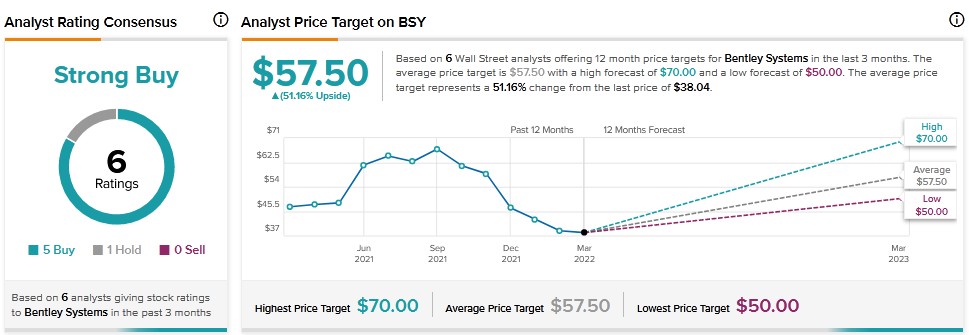

Goldman Sachs analyst Kash Rangan recently reiterated a Hold rating on Bentley Systems stock but lowered the price target to $52 from $60. Rangan’s reduced price target suggests 36.70% upside potential.

Consensus among analysts is a Strong Buy based on 5 Buys and 1 Hold. The average Bentley Systems price target of $57.50 implies 51.16% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure.

Related News:

Medtronic Rewards Shareholders with 8.6% Annual Dividend Hike

Nokia Bags Deal to Deploy 4G & 5G Network in Indonesia

What Can Investors Learn from NetApp’s Risk Factors