Alphabet (GOOGL) is the parent company of Google, the internet search engine giant whose other brands include YouTube and Google Cloud. In addition to Google, Alphabet’s other businesses are self-driving startup Waymo and life sciences-focused Verily. Alphabet is a component of the S&P 500, having first joined the index in 2014.

For Q4 2021, Alphabet reported a 32% year-over-year rise in revenue to $75 billion, surpassing the consensus estimate of $72.1 billion. It posted EPS of $30.69, which rose from $22.30 in the same quarter last year and beat the consensus estimate of $27.48.

Alphabet plans to do a 20-for-1 stock split in July if shareholders approve the proposal.

With this in mind, we used TipRanks to take a look at the risk factors for Alphabet.

Risk Factors

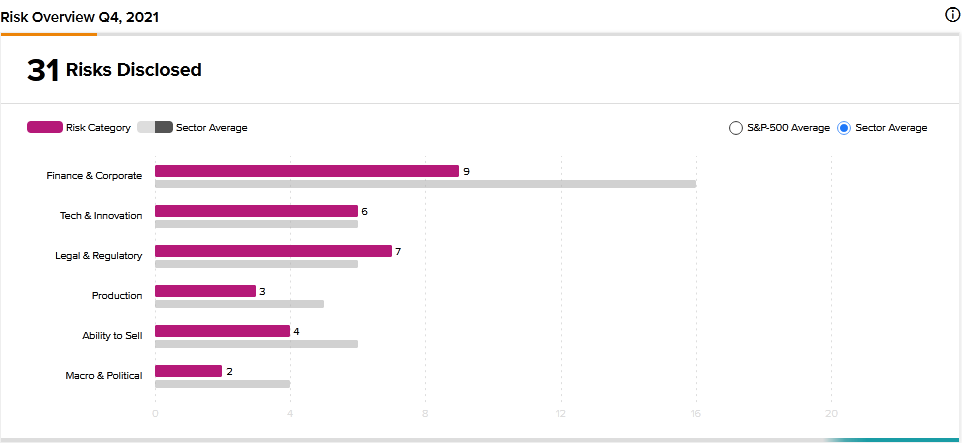

According to the new TipRanks Risk Factors tool, Alphabet’s top risk category is Finance and Corporate, which contains 9 of the total 31 risks identified for the stock. In this category, the company outlines the risk factors associated with the execution of its corporate activity and strategy. Legal and Regulatory and Tech and Innovation are the next two major risk categories, containing 7 and 6 risks, respectively. Alphabet has recently updated a number of its risk factors across the board to highlight certain challenges.

The company informs investors that its investments in new businesses, technologies, and products may not produce the expected results. It explains that its Google unit has continued to invest heavily in hardware products such as smartphones and home devices. But it cautions that the hardware market is highly competitive, mentioning that competitors frequently launch new products with advanced technologies and customers exhibit sensitivity to price and features.

In its Other Bets category, Alphabet says that it faces more experienced competitors and that its offerings may not be as profitable as it may hope. The company also cautions that its use of artificial intelligence technologies raises ethical and regulatory challenges, which may harm its brand and demand for its products.

Alphabet tells investors that its operations rely on complex information technology systems. It cautions that those systems are vulnerable to ransomware attacks, terrorist attacks, and the effects of climate change. Therefore, problems with the systems could hurt the company’s ability to provide its products and services, which could, in turn, damage its reputation and business.

Further, Alphabet reminds investors that the nature of its operations makes it subject to a variety of legal and regulatory proceedings. It mentions intellectual property, consumer protection, labor, tax, and commercial disputes. It cautions that such proceedings could divert management resources and generate negative publicity. Moreover, resolving such issues may result in huge fines, penalties, and injunctions that could harm Alphabet’s business and financial condition.

Analysts’ Take

Following Alphabet’s Q4 earnings report, Wedbush analyst Ygal Arounian reiterated a Buy rating on Alphabet stock and lifted the price target to $3,800 from $3,530. Arounian’s new price target suggests 32.78% upside potential.

The analyst noted the strong performance of Alphabet’s search business, noting that the business could be a beneficiary of Apple’s (AAPL) privacy changes, which have hurt some of Google’s advertising competitors.

Consensus among analysts is a Strong Buy based on 30 Buys. The average Alphabet price target of $3,508.67 implies 22.60% upside potential to current levels.

Download the TipRanks mobile app now.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Credit Suisse to Exit Nine Wealth Management Markets in Africa — Report

GoPro Q4 Earnings and Revenue Beat Estimates

Amazon Delivers Mixed Q4 Results Amid Higher Costs; Issues Guidance