Incyte and biotechnology company Cellenkos on Dec. 30 announced a partnership to assess the combination of ruxolitinib (Jakafi) and CK0804, cord blood-derived T-regulatory cells, in patients with myelofibrosis (MF). Shares of the biopharmaceutical company rose 1.2% at the close on Wednesday.

Ruxolitinib, sold under the brand name Jakafi is a medication for intermediate or high-risk MF. MF is a rare blood cancer that impairs the bone marrow’s ability to produce normal blood cells. It is part of a group of rare blood cancers called myeloproliferative neoplasms (MPNs) in which excess red blood cells, white blood cells, or platelets are produced in the bone marrow.

CK0804 is an allogenic cell therapy product consisting of T-regulatory cells that are derived from clinical-grade umbilical cord blood units and manufactured using Cellenkos’ proprietary process.

As part of the partnership agreement, Incyte (INCY) has an exclusive option to acquire sole rights to develop and commercialize CK0804, and genetically-modified variants of CK0804, in benign and malignant hematology indications.

The companies are planning to initiate a Phase 1b single arm, open-label study evaluating ruxolitinib in combination with CK0804 in patients with MF. Incyte will finance the study conducted by Cellenkos.

Additionally, Incyte will have an option to buy an exclusive global license to develop and commercialize the program. Upon exercising the global licensing option, the company will be responsible for all activities and costs associated with research, development and commercialization of the program.

In return, Cellenkos will be entitled to a $20 million licensing fee and, for each distinct product under the agreement, development, regulatory and sales milestones totaling up to $294.5 million along with tiered royalties ranging from mid-single digit to low-double digits, on approval.

“We are excited to partner with Cellenkos to initiate this study as part of our LIMBER clinical development program, designed to evaluate new monotherapy and combination strategies for patients with MPNs,” said Incyte Chief Medical Officer Steven Stein.

The Leadership In MPNs BEyond Ruxolitinib (LIMBER) program was designed to evaluate numerous monotherapy and combination strategies to improve treatments for patients with MPNs.

In reaction to Jakafi’s (ruxolitinib) RUXCOVID study miss reported earlier this month, Mizuho Securities analyst Mara Goldstein maintained a Hold rating on the stock on Dec. 14 with a price target of $95 (9.4% upside potential).

The results suggested that Jakafi in combination with standard-of-care (SOC) did not improve severe Covid-19 complications, including death, respiratory failure requiring mechanical intervention, or admission to ICU, compared to the control arm that received SOC alone.

“We view these Covid-19 programs as ancillary to the potential utility and commercialization of the existing JAKAFI franchise, and are not central to our main investment thesis of INCY,” Goldstein wrote in a note to investors.

The analyst expects Incyte to post a net loss per share of $0.07 in Q420. (See INCY stock analysis on TipRanks)

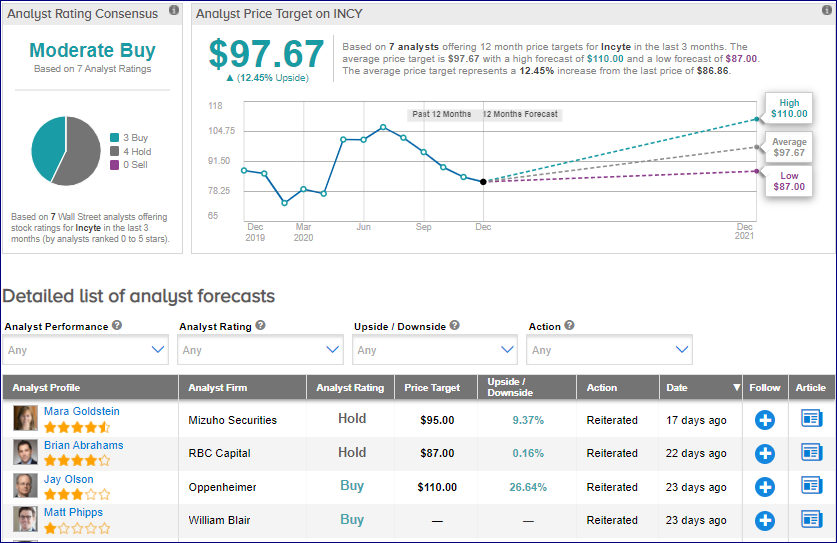

Overall, the rest of the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 3 Buys and 4 Holds. The average price target stands at $97.67 and implies 12.5% upside potential to current levels.

Related News:

Remarks Says Top Chinese Commercial Bank Selects Its Smart Retail Platform; Shares Rise 6%

Mission Broadcasting Snaps Up WPIX From Scripps For $75M; Street Says Buy

AIG To Redeem $1.5B In 2021 Notes; Street Is Cautiously Optimistic