Imperial Oil (NYSE Arca: IMO) (TSE: IMO) shares jumped almost 10% on October 28 after the company reported better-than-expected Q3-2022 results, smashing both earnings and revenue estimates. Investors cheered the raised production outlook as well the dividend hike.

Based in Canada, Imperial Oil Ltd. is an integrated oil company majorly owned by American oil giant ExxonMobil (NYSE: XOM)

A Snapshot of IMO’s Q3-2022 Results

Q3-2022 earnings of C$3.24 per share rose over 150% year-over-year and were also significantly ahead of analysts’ expectations of $2.77 per share.

Further, revenues jumped 48.8% year-over-year to C$15.22 billion and surpassed consensus estimates by C$1.7 billion.

The increase in revenues reflected a surge in upstream production as well as robust downstream operating performance with record refinery capacity utilization of 100%. Upstream production came in at 430,000 gross oil-equivalent barrels per day, driven by strong production at Kearl and Cold Lake.

Likewise, the company increased its full-year 2022 guidance at Cold Lake to between 140,000 to 145,000 gross barrels per day.

On top of that, the company announced a 29.4% hike in its quarterly dividend to 44 cents from 34 cents per share.

Is IMO Stock a Good Buy?

As per TipRanks, analysts are cautiously optimistic about Imperial Oil stock and have a Moderate Buy consensus rating, which is based on four Buys and six Holds. IMO’s average price forecast of $55.25 (C$75.20) implies 1.6% upside potential.

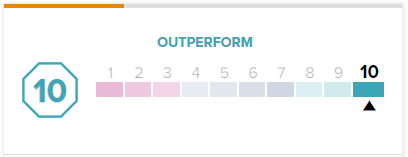

Notably, IMO stock has a ‘Perfect 10’ Smart Score on TipRanks, indicating that the stock has strong potential to outperform market expectations, going forward.