ChipMOS Technologies (IMOS) stock soared on Wednesday after the high-integration and high-precision integrated circuits company announced earnings results for the third quarter of 2025. This report started with the company’s adjusted earnings per share of 33 cents, which was well above Wall Street’s estimate of 11 cents per share. It also represented a 22.2% increase year-over-year from 27 cents per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

ChipMOS Technologies reported revenue of $201.7 million in Q3 2025, compared to analysts’ estimate of $198.11 million. The company’s revenue also climbed 1.2% year-over-year from $199.2 million and experienced a 7.1% increase from the $188.3 million reported in the second quarter of 2025.

ChipMOS Technologies stock was up 10.86% in pre-market trading on Wednesday, following a 1.69% drop yesterday. The stock has rallied 21.3% year-to-date and 14.51% over the past 12 months. Trading activity is high today at more than 16,000 shares, compared to a three-month daily average of about 11,000 units.

ChipMOS Technologies Guidance

ChipMOS Technologies didn’t provide a guidance update in its most recent earnings report. However, the company did provide some optimistic financial details for investors. Included in that is its strong financial position, with cash and cash equivalents of $426 million. The company said this came from revenue growth and prudent capital expenditures.

Is ChipMOS Technologies Stock a Buy, Sell, or Hold?

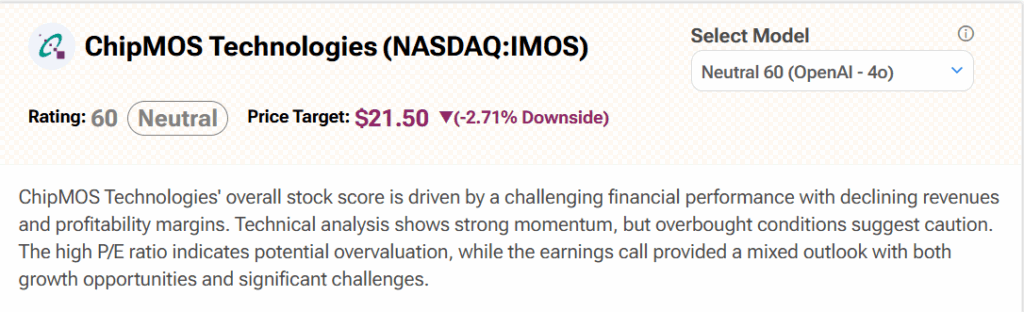

Turning to Wall Street, analyst coverage of ChipMOS Technologies is lacking. Fortunately, TipRanks’ AI analyst Spark has it covered. Spark rates IMOS stock a Neutral (60) with a $21.50 price target. It cites “challenging financial performance with declining revenues and profitability margins” as reasons for this stance. Spark could change its mind in light of today’s latest earnings report.