Illumina, Inc. (NASDAQ: ILMN) has announced preliminary results for 2021 and provided outlook for 2022. Further, the company has announced new partnerships and technologies to improve its product offerings.

Shares of biotechnology company rose 2.8% in Monday’s extended trading session to close at $372.50.

Preliminary Results and Outlook

Illumina has reported preliminary fourth-quarter revenue of about $1.19 billion, up 25% year-over-year. The upside can be attributed to the growth witnessed in both instruments and consumables categories.

The company delivered preliminary revenue of nearly $4.52 billion in 2021, reflecting a year-over-year increase of 39%. During the year, Illumina witnessed revenue growth across all regions and the highest number of shipments in its history.

For 2022, Illumina expects consolidated revenue to be in the range of $5.15 billion to $5.24 billion, reflecting a rise of 14% to 16% year-over-year.

“We are seeing incredible acceleration of genomics in healthcare, driving an outstanding 2021 for Illumina and strong momentum for 2022 and beyond,” said, Francis deSouza, the CEO of Illumina.

New Partnerships

To improve advanced cancer treatment offerings, Illumina announced that it has partnered with Agendia to develop genome-based panel tests for cancer diagnosis and Boehringer Ingelheim to identify which patients are best suited to the company’s new medicines on the basis of the molecular profile of their cancer.

Illumina has also collaborated with Optum to speed up the adoption of genomics into clinical practice. With the help of Optum Evidence Engine, which provides real-world data and healthcare expertise to generate evidence of clinical utility, companies can conduct studies to identify, validate and demonstrate the efficacy of genomics-based testing.

Further, the company has joined hands with Nashville Biosciences to drive improved therapeutic development. The deal is expected to leverage Illumina’s AI capabilities, genome interpretation, and scaled analytic infrastructure to support the identification of new genomic-based drug targets.

Wall Street’s Take

On January 10, Barclays analyst Luke Sergott reiterated a Sell rating on Illumina and lowered the price target to $350 from $365. The new price target implies 3.4% downside potential.

Based on 2 Buys, 5 Holds and 2 Sells, the stock has a Hold consensus rating. The Illumina stock price prediction of $420.25 implies 16% upside potential. Shares have lost 4.9% so far this year.

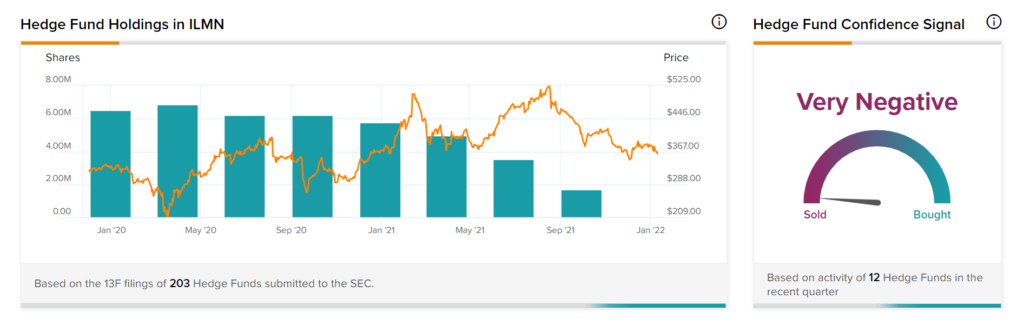

Decreased Hedge Fund Trading

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Illumina is currently Very Negative, as the cumulative change in holdings across all 12 hedge funds that were active in the last quarter was a decrease of 1.8 million shares.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Download the TipRanks mobile app now

Related News:

Discovery Buys Minority Stake in OpenAP

Medtronic to Enhance Product Offerings with Affera

fuboTV Releases Preliminary Q4 Results; Shares Down 8.4%