IHS Markit reported better-than-expected fiscal 1Q (ended Feb. 28) results. Top-line growth was the primary driver.

IHS Markit’s (INFO) 1Q adjusted earnings of $0.71 per share rose 8% on a year-over-year basis and outpaced the Street estimates of $0.70 per share. Revenues grew 3.6% to $1.12 billion and surpassed analysts’ expectations of $1.11 billion.

Higher revenues in financial services and transportation segments were partly offset by declines in resources and consolidated markets & solutions segments. Adjusted EBITDA came in at $466.8 million in the quarter, up 8% year-over-year. (See IHS Markit stock analysis on TipRanks)

For the fiscal year 2021, the company anticipates total revenue of $4.535 billion to $4.635 billion, with the mid-point of $4.585 billion. Adjusted EPS is forecasted to be in the range of $3.11 to $3.16, with the mid-point of $3.14.

IHS Markit’s CFO Jonathan Gear said, “As our end markets and business continue to recover, we now expect to deliver results in the upper half of our 2021 revenue, Adjusted EBITDA, and Adjusted EPS guidance ranges.”

Earlier in March, IHS Markit’s shareholders approve its merger with S&P Global (SPGI), which was announced last November. The deal, which awaits regulatory approvals, is expected to close in the second half of 2021.

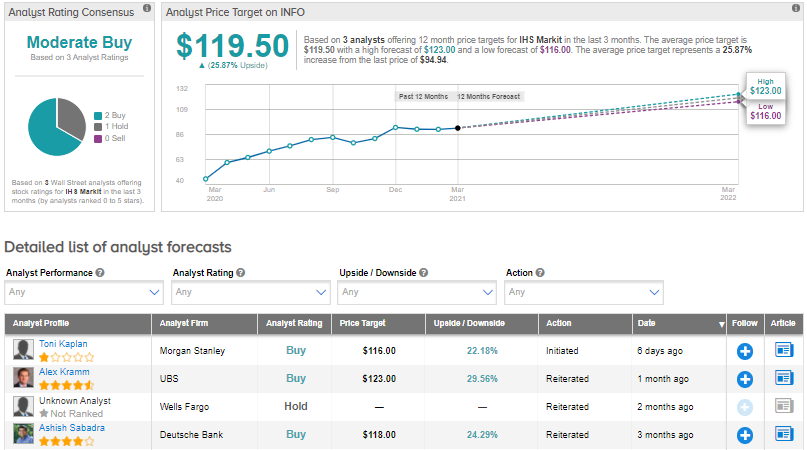

On March 18, Morgan Stanley analyst Toni Kaplan resumed coverage of the stock with a Buy rating and a price target of $116 (22.2% upside potential).

In a note to investors, Kaplan said that the merger of S&P Global (SPGI) and IHS will form a leading information services provider with a “unique position among peers to expand in high growth areas.”

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating. That’s based on 2 Buys versus 1 Hold. The average analyst price target of $119.50 implies almost 26% upside potential to current levels. Shares have increased 23.9% over the past six months.

Related News:

Ametek Inks Deal To Acquire Abaco Systems For $1.35B

Embraer Posts Smaller-Than-Feared Quarterly Loss; Shares Pop 7%

FDA Accepts New Drug Application For Bristol Myers Squibb’s Mavacamten