IDEX Corporation (IEX), a manufacturer of fluidics systems and specialty engineered products, delivered solid second-quarter results driven by record orders and backlog, and favorable pricing trends. Shares closed marginally higher at $226.25 on July 27.

In the second quarter, the company reported adjusted earnings of $1.61 per share, up 46.4% year-over-year, but marginally missed the consensus estimate of $1.62 per share.

Revenue increased 22% year-over-year to $685.9 million, while orders climbed 44% to $751 million.

During the quarter, IDEX completed the acquisition of Airtech Group, Inc. on June 14, for $469.3 million, and also hiked its quarterly dividend by 8% to $0.54 per share. (See IDEX stock charts on TipRanks)

Eric D. Ashleman, the company’s CEO and President said, “Backlog is at a record level resulting from strong demand across all segments and geographies, with $65 million added in the second quarter…Global supply chain constraints, component shortages, and inflation are daily challenges, but the teams continue to deliver for our customers, and IDEX continues to perform extremely well.”

Based on the robust second-quarter performance, the company raised its full-year 2021 adjusted earnings guidance to between $6.26 and $6.36 per share. This includes a forecast of adjusted EPS in the third quarter of between $1.57 and $1.61 per share.

Additionally, the company also projects organic revenue to grow by 11% – 12% for the full year, including third-quarter organic revenue growth in the range of 14% – 16%.

Following the results, Oppenheimer analyst Bryan Blair reiterated a Hold rating on the stock. Blair noted that the company’s results were affected by the underperformance of its Fluid & Metering Technologies and Fire & Safety/Diversified Products segments, but were largely offset by strong results in its Health & Science Technologies segment.

Blair said, “Although 2Q was a somewhat noisy quarter for high-quality IDEX, its strong order trends, elevated backlog, and reacceleration of capital deployment suggest a return to beat & raise progression during the back half.”

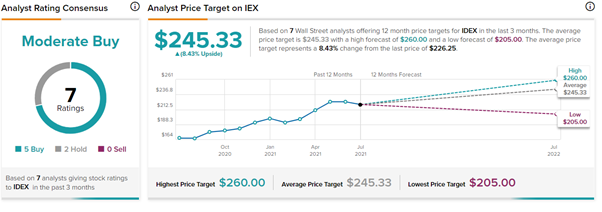

Overall, the stock has a Moderate Buy consensus rating based on 5 Buys and 2 Holds. The average IDEX price target of $245.33 implies 8.4% upside potential to current levels. Shares have gained 36.8% over the past year.

Related News:

Aon and Willis Towers Watson Terminate $30B Merger

Lumen Announces Divestment of LATAM Business to Stonepeak for $2.7B

ABB to Sell its Dodge Business to RBC Bearings for $2.9B