How is IBIT stock faring? The iShares Bitcoin Trust (IBIT) was back in the groove today. It is now down only 1.53% over the past 5 days and is 10.99% higher in the year-to-date.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

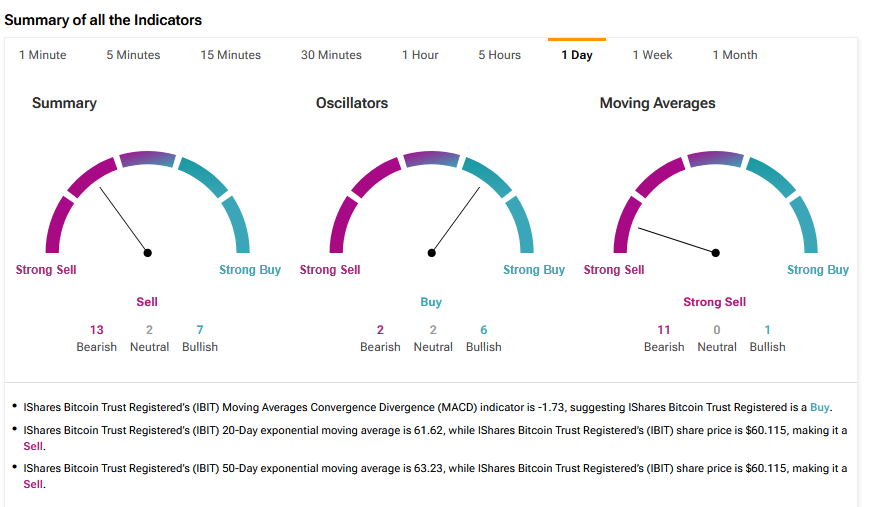

According to TipRanks’ technical analysis, the IBIT is now at a Strong Sell consensus based on 13 Bearish, 2 Neutral and 7 Bullish ratings.

Based on the activity of 827,325 investors in the recent quarter, it has scored sector-average neutral sentiment. Those investors aged between 35 and 55 have been the most active buyers.

In total, 1.9% of all portfolios hold IBIT.

Today’s IBIT Performance

Today, the IBIT was up 2.14% at $60.17 The main driver was the price of Bitcoin, which rose 1.19% to $105,936.34.

It was boosted by Strategy (MSTR) which revealed that during the period from November 3 to November 9, 2025, it sold shares of various securities, generating net proceeds of $50 million. The proceeds from these sales were used to acquire 487 bitcoins, increasing the company’s aggregate bitcoin holdings to 641,692.

Strive also announced that between October 28, 2025, and November 9, 2025, it purchased approximately 1,567.2 bitcoin at an average price of $103,315.46 per bitcoin, totaling $161,912,220. As a result, Strive’s total bitcoin holdings increased to approximately 7,525 bitcoin, positioning the company as one of the top corporate holders of bitcoin.

Power up your ETF investing with TipRanks. Discover the Top Equity ETFs with High Upside Potential, carefully curated based on TipRanks’ analysis.