HP Inc. inked a deal to buy HyperX, the gaming unit of Kingston Technology Company, in a cash deal worth $425 million. The transaction is likely to boost the technology company’s growth in peripherals and expand its gaming network. HP shares surged almost 2.2% to close at $27.97 on Feb. 24.

Per the terms of the deal, HyperX’s gaming peripherals portfolio will be acquired by HP (HPQ). However, the DRAM, flash, and SSD products will be retained by Kingston.

The transaction, which awaits regulatory approval, is anticipated to close in the second quarter of 2021. After closure, the deal is expected to boost HP’s adjusted earnings in the first full year.

Based on market statistics, HP anticipates the global peripherals market to reach $12.2 billion by 2024, including a “disproportionate” share of the growth of gaming peripherals. Recently, HP’s gaming portfolio has been gaining momentum with the popularity of its OMEN brand.

HP CEO Enrique Lores said, “HyperX is a leader in peripherals whose technology is trusted by gamers around the world and we’re thrilled to welcome their outstanding team to the HP family.”

“We continue to advance our leadership in Personal Systems by modernizing compute experiences and expanding into valuable adjacencies. We see significant opportunities in the large and growing peripherals market, and the addition of HyperX to our portfolio will drive new sources of innovation and growth for our business,” Lores added. (See HP stock analysis on TipRanks)

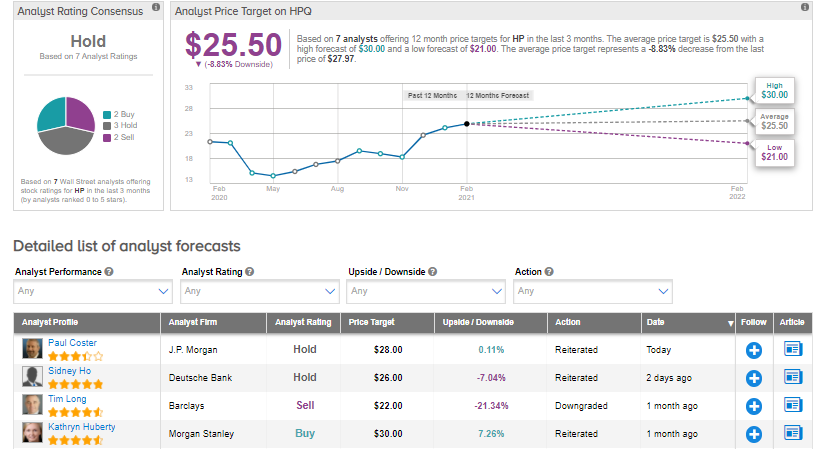

On Feb. 24, J.P. Morgan analyst Paul Coster increased the stock’s price target to $28 from $26 and maintained a Hold rating. In a note to investors, the analyst said, “PC strength continues to extend from the summer particularly in education and consumer channels.”

Additionally, Coster expects “HP to benefit from PC demand despite modest market share declines.”

The Street consensus rating on the stock is a Hold. That’s based on 3 Holds, 2 Buys and 2 Sells. Looking ahead, the average analyst price target stands at $25.50, putting the downside potential at about 9% over the next 12 months. Shares have jumped almost 56% over the past six months.

Related News:

Western Alliance To Buy AmeriHome For $1B; Shares Drop 3.5%

Redfin To Buy RentPath For $608M; Shares Jump 12%

Autodesk To Snap Up Innovyze For $1B; Street Sees 14% Upside