Online retail giant Amazon (NASDAQ:AMZN) is ensuring that it is fully prepared to meet the demand ahead of the upcoming holiday season. Amazon is making efforts to be prepared by offering increased pay as well as perks and benefits to its delivery partners. The move is much needed, given an already squeezed labor market and the labor union challenges faced by the company recently.

Under its newly coined academic program, Next Mile, the delivery drivers will be entitled to $5,250 annually toward over 1,700 academic programs. The programs include bachelor’s and associate degrees, certifications, and high school completion courses.

Further, the company has introduced retirement savings benefits under a 401(k) plan for its delivery service partners (DSPs). During the first year, Amazon will provide DSPs approximately $60 million to help small business owners match employee contributions.

During the past four years, Amazon has made investments of more than $7 billion globally toward safety technology, driver training programs, higher rates to its DSPs, and more.

Parisa Sadrzadeh, VP of Amazon’s Worldwide Delivery Service Partner Program, stated, “Through the DSP program, small businesses around the world have generated over $26 billion in revenue for their companies since launching four years ago.”

He further added, “We couldn’t have done that without DSPs and their incredible teams. We will continue to innovate with them and use our economies of scale and resources to help them provide best-in-class offerings to their employees.”

Is Amazon Stock a Buy, Hold, or Sell?

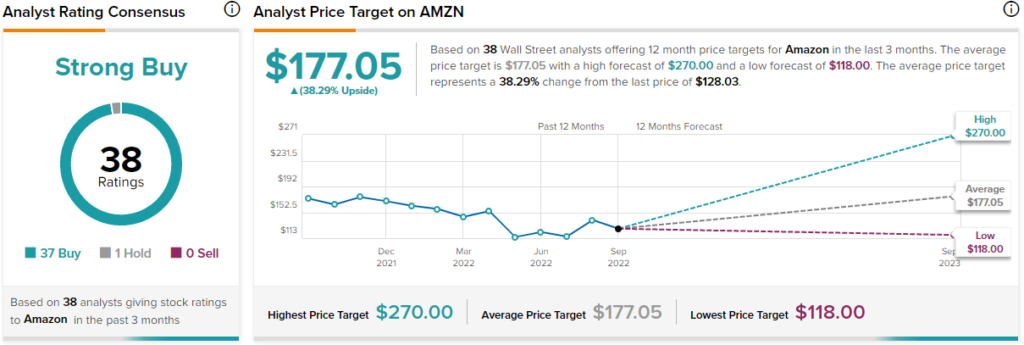

Turning to Wall Street, analysts are very optimistic about Amazon stock, giving it a Strong Buy consensus rating based on 37 Buys and one Hold. Amazon’s average price forecast of $177.05 implies 38.3% upside potential from current levels.

Yesterday, Truist Securities analyst Youssef Squali reiterated a Buy rating on Amazon with a price target of $180 (40.58% upside potential).

Squali is bullish on the stock based on the current quarter’s dynamics that are “trending to the higher-end of expectations in the US, reflecting sustained demand driven by AMZN’s superior value proposition in this challenging environment. A stickier Prime, sustained growth in AWS and in the ads biz are helping AMZN thrive in the face of a weakening macro, which is all the more impressive considering AMZN controls ~41% of US ecom share.”

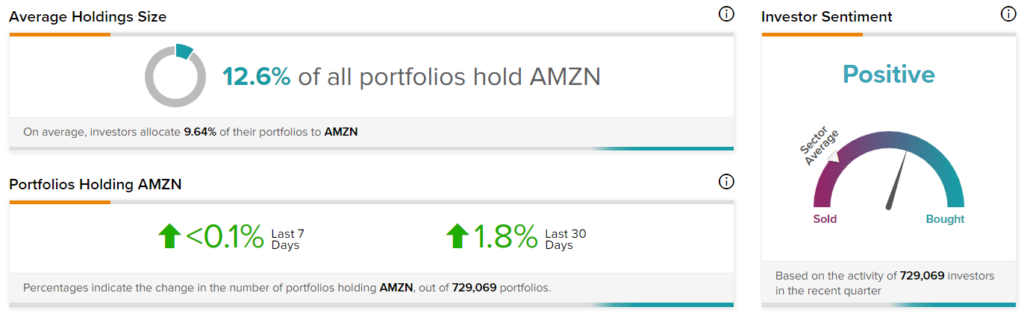

On top of this, the retail investor community on TipRanks is positive on Amazon stock, with the number of portfolios holding AMZN stock increasing by 1.8% in the past 30 days.

Conclusion: AMZN Stock May Present a Buying Opportunity

Amazon is on a path to recovering its lost market capitalization of over 25% over the past year. In the coming days, Amazon’s expected stock price correction due to a potentially large increase in interest rates could present great buying opportunities for long-term investors.