Horizon Therapeutics has agreed to buy biotech company Viela Bio for $3 billion, according to an announcement on Feb. 1. Shares of Horizon closed 6.3% higher, while Viela Bio stock shot up 53% on Monday.

According to the terms of the deal, Horizon Therapeutics (HZNP) will pay $53 for each outstanding share of Viela. The company expects the Viela acquisition will reduce its adjusted EBITDA by nearly $140 million in FY21. The companies anticipate that the transaction will close by the end of the first quarter of this year.

Horizon said the acquisition of Viela (VIE) would add to the company’s rare disease commercial medicine portfolio as Viela’s uplizna is its first and only FDA approved drug for treatment of neuromyelitis optica spectrum disorder (NMOSD) – a rare autoimmune disorder. The acquisition would also strengthen Horizon’s current research and development capabilities.

Horizon CEO Tim Walbert said, “This acquisition represents a significant step forward in advancing our strategy – to expand our pipeline in order to accelerate our growth over the long term.” (See Horizon Therapeutics stock analysis on TipRanks)

“Adding Viela’s research and clinical development capabilities along with its deep, mid-stage biologics pipeline to our seasoned R&D and commercial teams, advances our transformation to an innovation-driven biotech company to bolster our long-term growth trajectory.” Walbert added.

Following the deal announcement, Stifel Nicolaus analyst Derek Archila raised the price target for Viela stock from $46 to $53 and reiterated a Hold rating .

“We think the deal continues to speak to the significant interest in the immunology category (MNTA, PRNB, AIMT, ALXN – all other recent acquisitions in the immunology space) and while we were more cautious on VIE’s Uplizna launch in NMOSD, we generally had a favorable view on VIE’s emerging pipeline which seems to be the key driver of the acquisition,” Archila wrote in a note to investors.

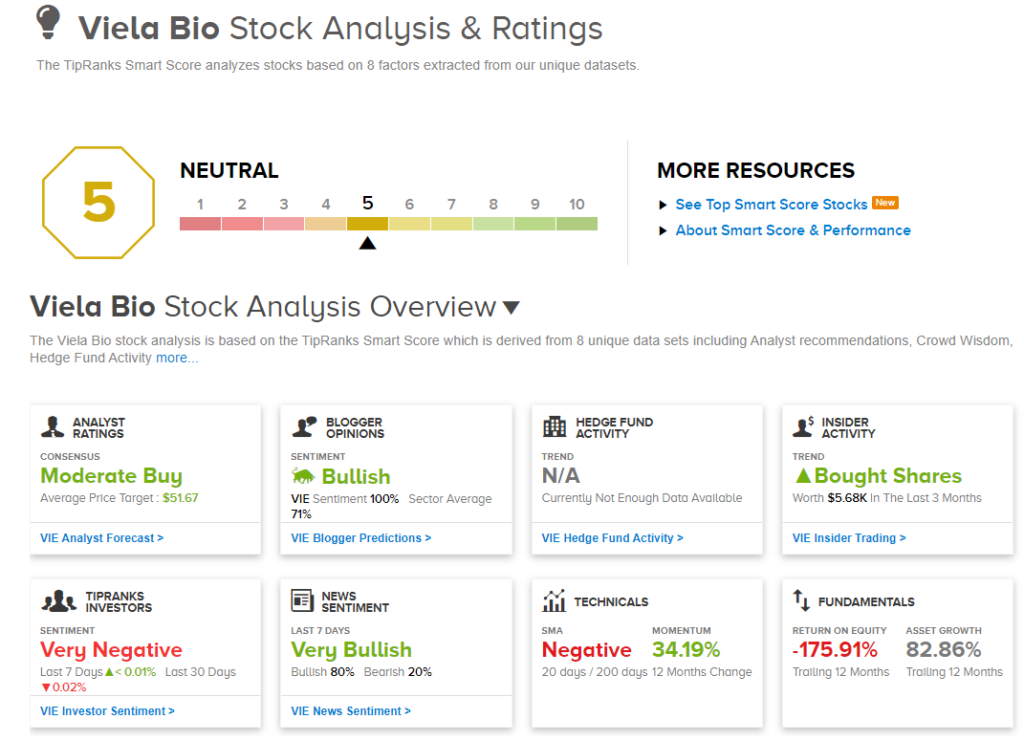

The rest of the Street is cautiously optimistic about Viela with a Moderate Buy consensus rating. That’s based on 1 analyst recommending a Buy and 2 analysts suggesting a Hold on the stock. The average analyst price target of $52 implies 1.5% downside potential to current levels.

Viela Bio scores a Market Neutral 5 out of 10 on TipRanks’ Smart Score, which indicates that VIE shares are likely to perform in line with market expectations.

Related News:

Virgin Galactic Shares Pop 14% Pre-Market After Flight Test Program Update

Gray Television Gains 5.3% On $925M Takeover Bid For Quincy Media

FB Financial Ramps Up Dividend By 22%