Honeywell Building Technologies (HON) has entered into an agreement to start upgrading facilities at the Kunsan Air Base in South Korea.

The company will work to improve fuel supply reliability at the US airbase, installing natural gas services in order to reduce energy use by 11%.

Additionally, the company is tasked with modernizing 25 buildings by converting boilers from fuel oil to natural gas. The company will also install a distribution network to deliver natural gas.

Upon completion, the $23 million project will significantly reduce the need for frequent fuel oil deliveries. It will also help enhance airman quality of life through the installation of easy-to-maintain heating systems. Honeywell also expects the upgrades to benefit South Korea, given the expected reduction of carbon dioxide, nitrogen oxide and sulfur dioxide. (See Honeywell stock analysis on TipRanks)

“With locally sourced and serviced equipment and materials, maintenance can be completed more quickly, allowing service personnel to focus their time and attention on their mission,” said Jose Simon, Honeywell Building Technologies’ Vice President and GM of projects.

In addition to upgrading the heating systems, Honeywell will also modernize and enhance the buildings’ monitoring and control systems, thus improving cybersecurity. This is not the first time that the company has been tasked with carrying out upgrades at the base. In 2017, it upgraded the base to LED lighting and also installed advanced building control systems.

Oppenheimer analyst Christopher Glynn maintains a Hold rating on the stock in the wake of the company’s report of impressive Q1 results. According to the analyst, the rating reflects a view of robust talent management, operations and industry positions.

“HON features strong continuing investment into market leading solutions around industrial cyber-security and Internet of Things, and virtual operations solutions for industries including aviation and process, all tied to core verticals and building on deep customer relationships,” Glynn wrote in a research note to investors.

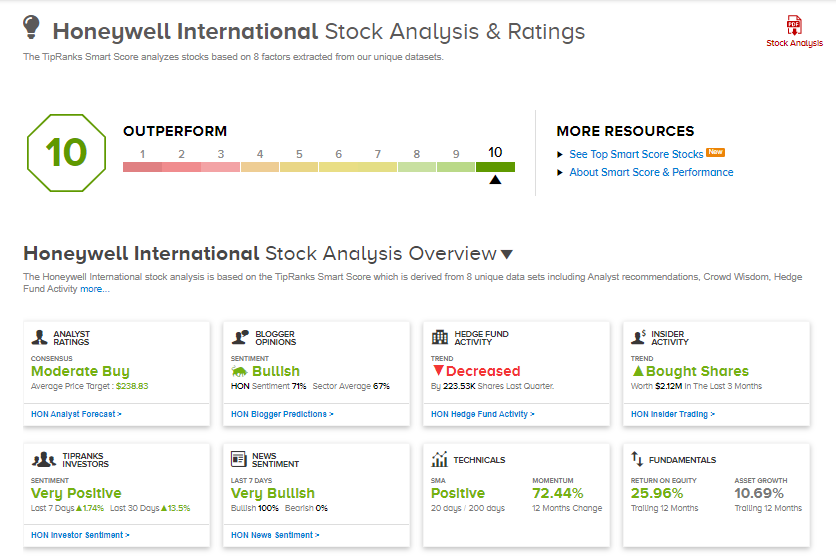

Consensus among analysts on Wall Street is a Moderate Buy based on 8 Buy and 5 Hold ratings. The average analyst price target of $238.83 implies 3.42% upside potential to current levels.

HON scores a “Perfect 10” on the TipRanks’ Smart Score rating system, implying it is likely to outperform the overall market.

Related News:

Luminar Partners With Toyota’s Pony.ai To Enhance Safe Autonomous Driving

CGI Wins Public Sector Tender Worth C$576M In Finland

Nikola Inks LOI With TTS To Supply 100 Trucks