Honeywell International Inc. and TAT Technologies, a provider of products and services to the aviation industry, have inked a 10-year agreement for Auxiliary Power Unit (APU) rental services for its GTCP331-500 engine, which is installed in all Boeing 777 aircraft around the world. Nasdaq-listed TAT shares popped 58% in Tuesday’s late market trading.

Under the terms of the contract, TAT’s subsidiary, TAT-Piedmont Aviation, will offer rental services of Honeywell (HON) GTCP331-500 APUs operating Boeing’s 777 aircraft on an exclusive basis. As part of this agreement, TAT-Piedmont also acquired Honeywell’s GTCP331-500 APU rental bank for about $6.5 million.

In addition, TAT-Piedmont and Honeywell entered into a binding memorandum of understanding for TAT-Piedmont to provide maintenance, repair and operations (MRO) services for GTCP331-500 APU engines.

“This agreement is a significant step in the development of TAT-Piedmont as a major global player in the APU MRO services business,” TAT (TATT) CEO Igal Zamir stated. “The rental services agreement and, to a larger extent, the authorization to provide MRO services, consist of major growth opportunities for TAT. The introduction of the GTCP331-500 APU to our offering is expected to substantially increase the potential market size available for TAT-Piedmont. This new agreement is expected to add revenues and generate profits for TAT in the near future.”

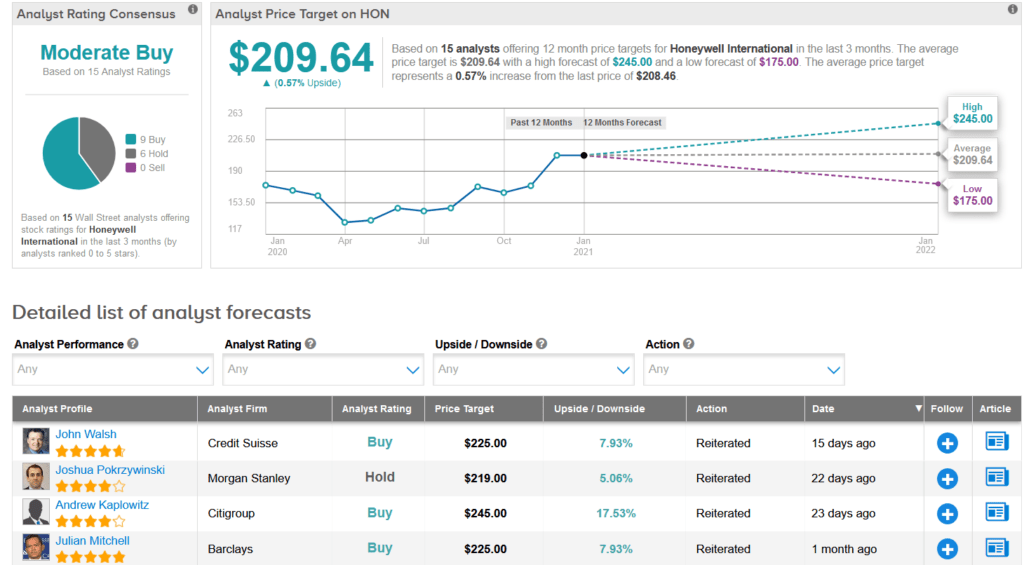

Honeywell shares have advanced 25% over the past three months and are up 17% over the past year. Meanwhile, Wall Street analysts are cautiously optimistic on the stock with a Moderate Buy consensus. That’s with an average price target of $209.64, which indicates that shares are almost fully priced at current levels.

Following Honeywell’s release of third-quarter results, Cowen analyst Gautam Khanna lifted the stock’s price target to $190 from $160 and reiterated a Buy rating.

“Q3 revealed HON’s urgent cost controls & sequential sales gain in high margin, commercial aero aftermarket submarkets,” Khanna wrote in a note to investors. (See Honeywell stock analysis on TipRanks)

Related News:

Workhorse Rises 8% On EV Order From Pride; Top Analyst Stays Bullish

Tesla’s 2020 Deliveries Beat Street’s Forecast; Analysts See 35% Downside

Xpeng’s December Deliveries Surge, Reflect Robust EV Demand