Hillenbrand has agreed to sell its Abel pumps and certain affiliates to IDEX Corp. for $103.5 million in cash. The company said that the divestment is in-line with its strategy to exit its flow control business and streamline its portfolio.

Hillenbrand (HI) plans to use the Abel sale proceeds to reduce its leverage, and thereby improve its balance sheet.

The company expects the deal with IDEX (IEX) to close in the second quarter of fiscal 2021, ending in March.

Earlier this month, Hillenbrand completed the divestment of its Red Valve business to DeZURIK Inc. for $63 million and used the proceeds to deleverage its balance sheet. (See HI stock analysis on TipRanks)

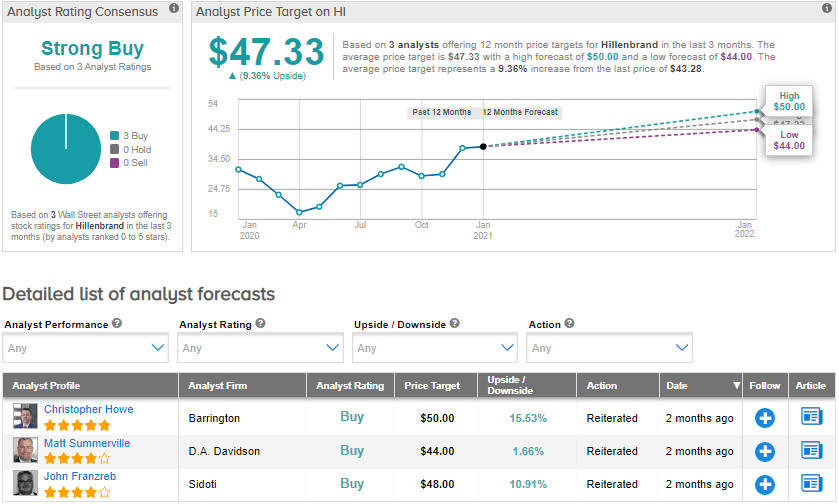

On Nov. 19, Barrington analyst Christopher Howe maintained a Buy rating and a price target of $50 (15.5% upside potential) on the stock. The analyst said, “The company continues to prioritize paying down debt following the recent acquisition of Milacron, reinvesting for growth, and supporting the dividend.” Hillenbrand completed the $1.9 billion Milacron deal in Nov. 2019.

From the rest of the Street, the stock scores a bullish Strong Buy analyst consensus based on 3 unanimous Buys. The average analyst price target of $47.33 implies upside potential of about 9.4% to current levels. Shares have gained 37.5% over the past year.

Related News:

Hillenbrand Completes $63M Sale Of Red Valve Unit; Street Sees 19% Upside

Nio To Raise $1.3B From Debt Sale; Street Sees 11% Downside Risk

Baidu Gains 4% On Geely Partnership For EV Venture; Street Is Bullish