CoreWeave (NASDAQ:CRWV) certainly seems to be at the right time at the right place. The provider of GPUs-as-a-Service has ridden the surging wave of AI demand, and CRWV’s share price has increased by 260% since its IPO earlier this spring.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company’s revenues have been growing at an astonishing rate, up from $395 million in Q2 2024 to $1.2 billion in Q2 2025, its last reported quarter. Moreover, the company had a revenue backlog of $30.1 billion at the end of last quarter, signaling that the intense demand for computing power is showing no signs of slowing down.

Indeed, McKinsey & Company estimates that global demand for data center capacity could expand by 3x between now and 2030. In monetary terms, the consulting firm also predicts that there will be close to $7 trillion in capex spending for data center infrastructure around the world by the end of the decade.

While there’s no doubt that CoreWeave finds itself in a promising position, will the company’s share price move in tandem with the projected market demand? Top investor Manali Pradhan believes it certainly could.

“CoreWeave enjoys exceptional multi-year revenue visibility,” notes the 5-star investor, who is among the top 4% of stock pros covered by TipRanks.

Pradhan emphasizes the global appetite for data center demand, as the global desire for compute capacity is heating up. It follows that CoreWeave “stands to benefit dramatically” if this spending plays out as predicted.

Regarding CoreWeave’s sales, the investor points out that Wall Street analysts are projecting soaring revenues of $18.09 billion by the end of 2027. Pradhan estimates that CoreWeave could have a market capitalization of $235.2 to $271.3 billion by the end of Fiscal 2027, or between 3.5 to 4.1 times its current market cap.

That doesn’t mean that Pradhan is blind to some of the challenges that CoreWeave could face in the years ahead, including customer concentration risk and increasing competition from hyperscalers.

Still, she ultimately concludes that CRWV could reward investors handsomely.

“Although it’s a high-risk stock, it may soar dramatically in the next couple of years,” sums up Pradhan. (To watch Manali Pradhan’s track record, click here)

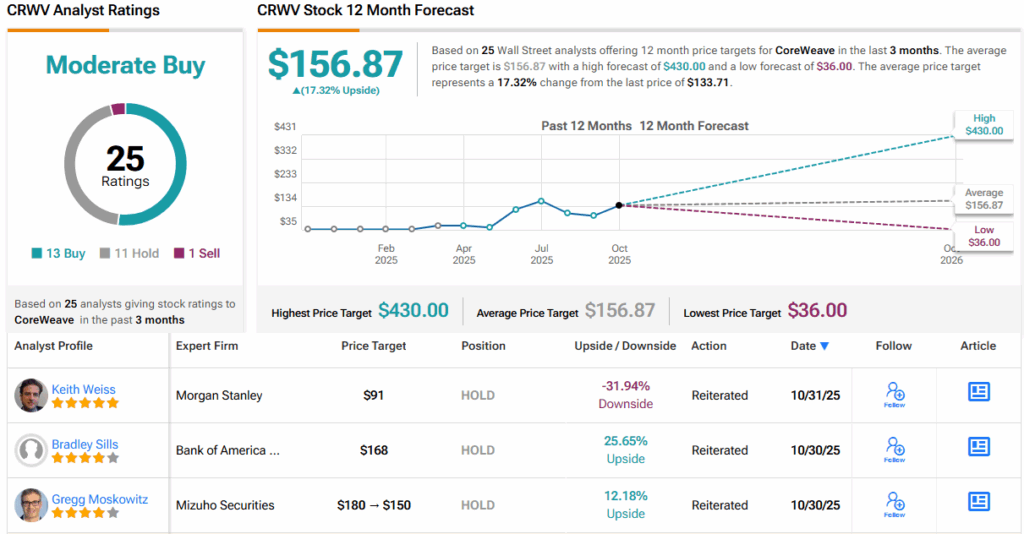

Wall Street is by-and-large supportive of CRWV. With 13 Buys, 11 Holds, and 1 Sell, CRWV carries a Moderate Buy consensus rating. Its 12-month average price target of $156.87 implies gains of 17%. (See CRWV stock forecast)

To find good ideas for AI stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.