Shares of High Liner Foods Inc (HLF) fell more than 5% in early trading Tuesday after the company reported lower sales and sales volume in its first quarter. High Liner is a Canadian marketer and processor of frozen fish and seafood.

In High Liner’s foodservice business, operators faced dining restrictions and closures in North America during the entire quarter. Within its retail segment, the surge in retail demand in March 2020 at the start of the pandemic, wasn’t present in March 2021. As a result, quarterly sales volumes declined year-over-year in both foodservice and retail business.

Sales volume decreased 9.7% to 69.8 million pounds, while sales fell 9.4% to $243.4 million, reflecting the impact of COVID-19 throughout Q1 2021 compared to the last two weeks of Q1 2020.

Meanwhile, net income increased 25.4% to $17.8 million in the three months ended April 3, 2021. Diluted EPS increased to $0.51 per share from $0.41 per share in the prior-year quarter.

On an adjusted basis, net income decreased 1.4% to $14.1 million. Adjusted diluted EPS decreased to $0.40 per share compared to $0.41 per share a year ago due to the impact of COVID-19.

High Liner Foods’ President and CEO Rod Hepponstall said, “Our Q1 results demonstrate the continued resilience of our business, improving gross profit and the foodservice recovery that is underway. In both our retail and foodservice businesses, we are executing against our strategy and driving profitability gains as a percentage of sales. Our efforts to build a strong, integrated supply chain and a diversified portfolio has served us well during this time of heightened global supply challenges.”

Gross margin as a percentage of sales increased to 23.7% from 21.9% in the prior-year quarter. (See High Liner Foods Inc stock analysis on TipRanks)

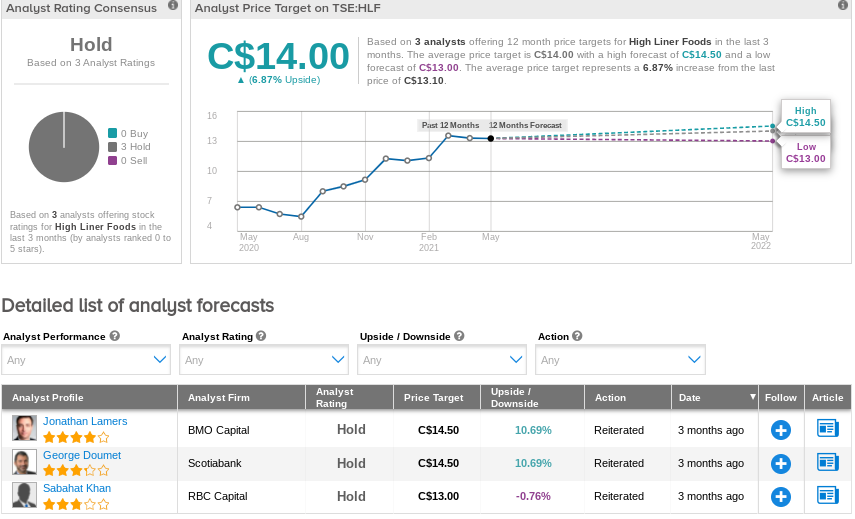

Three months ago, BMO Capital analyst Jonathan Lamers maintained a Hold rating on HLF. He raised its price target to C$14.50 (from C$11.00), for 10.7% upside potential.

Overall, consensus on the Street is that HLF is a Hold based on 3 Holds. The average analyst price target of C$14.00 implies 7% upside potential to current levels. Shares have nearly doubled in value over one year.

Related News:

Rritual Superfoods Teams Up With Ultimate Sales Canada

George Weston Swings To A 1Q Loss, Hit By One-Time Charges

Maple Leaf Foods Earns C$47.7M Profit In 1Q; Shares Fall 4%