HEXO (HEXO) posted higher sales but a wider loss in the first quarter of 2022, as the company announced a new strategic plan to cut costs.

HEXO is a Canadian cannabis company focused on smoke-free and traditional cannabis products. (See Insiders’ Hot Stocks on TipRanks)

Revenue & Earnings

Total net revenue for Q1 2022 came in at C$50.2 million, up 70% from C$29.5 million in Q1 2021. Total non-beverage gross margin before adjustments excluding Quebec decreased to 28% from 39% in the prior-year quarter.

The company posted a net loss of C$116.9 million in the first quarter, compared to a loss of C$4.2 million a year ago. The loss was C$0.46 per diluted share for the quarter ended October 31, down from a loss of C$0.04 per diluted share a year ago.

Management Commentary

HEXO president and CEO Scott Cooper said, “We are taking immediate steps through our new strategic plan, The Path Forward, to strengthen our capital position, improve operations, accelerate organic growth and complete our transformation to be cash flow positive from operations within the next four quarters.

“Having visited all our core sites, and in meeting with our employees and customers, I am more confident than ever in HEXO’s future and our ability to accelerate the creation of short and long-term value for shareholders.”

HEXO also announced a series of management changes. The company said Jackie Fletcher has been appointed vice-president, Science & Technology, and CFO Trent MacDonald will step down effective March 11.

John Bell has been appointed chair of the board, replacing Michael Munzar, who has resigned from the board.

Wall Street’s Take

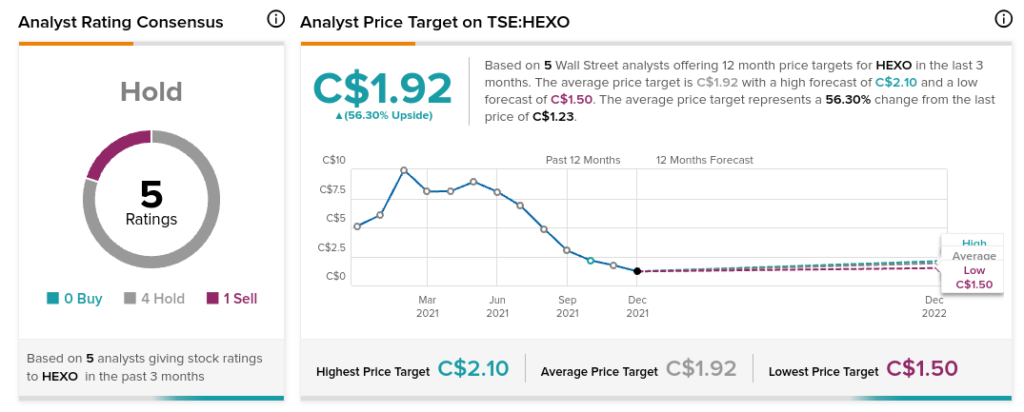

Last month, BMO Capital analyst Tamy Chen maintained a Hold rating on HEXO and set a C$2 price target. This implies 62.6% upside potential.

Consensus among analysts is that HEXO is a Hold based on four Holds and one Sell. The average HEXO price target of C$1.92 implies 56.3% upside potential to current levels.

Related News:

TerrAscend Swings to Profit in Q3, Sales Rise

Village Farms Buys 70% Stake in ROSE LifeScience

Aurora Cannabis Q1 Revenue Falls 11%