Hewlett Packard Enterprise (HPE) has reached an agreement to acquire Zerto for $374 million in cash. The acquisition should close in the fourth quarter and is expected to contribute about $130 million in run-rate revenues.

Zerto will accelerate Hewlett Packard’s research and development talent portfolio. It is also expected to expand HPE GreenLake cloud data services amid a push to help customers protect their data.

Zerto’s technology is best known for data mobility, disaster recovery, and backup. Additionally, these solutions help customers bounce back from ransomware and cyber-attacks.

HPE is acquiring Zerto when data protection as-a-service (aaS) is projected to be worth $15.3 billion by 2024 from $7.7 billion in 2020. (See Hewlett Packard Enterprise stock chart on TipRanks)

“Customers continue to face significant issues managing data complexity across hybrid and multi-cloud environments. Zerto further positions HPE to help solve these customer challenges and become the leader in data management and protection through HPE GreenLake cloud services,” said SVP and GM of HPE Storage, Tom Black.

Last month, Jefferies analyst Kyle McNealy reiterated a Buy rating on the stock following strong April-quarter results characterized by an 11% year-over-year increase in sales to $6.7 billion. The analyst has a $20 price target implying 36.05% upside potential to current levels.

McNealy stated, “We think the stabilization in the core Compute and Storage businesses, improving total company order rates, and “strong demand momentum” support our thesis that the company will benefit from ongoing digitization efforts across Enterprises in response to the post-pandemic new normal.”

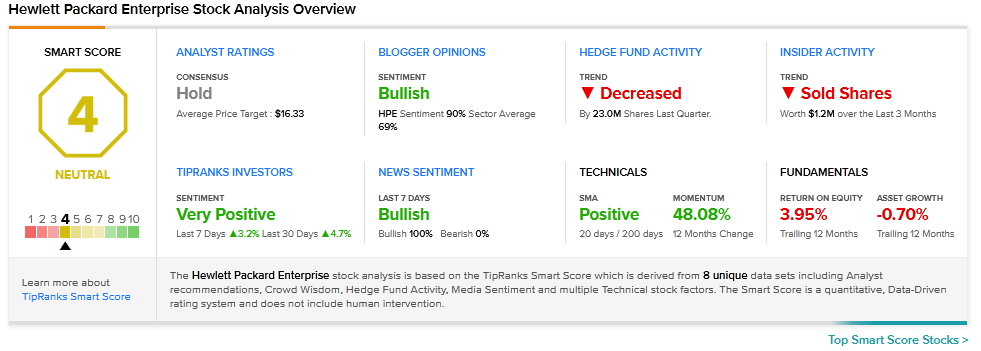

Consensus among analysts is a Hold based on 4 Buys, 7 Holds, and 2 Sell. The average Hewlett Packard Enterprise price target of $16.33 implies 11.09% upside potential to current levels.

HPE scores a 4 out of 10 on TipRanks’ Smart Score rating system, suggesting that the stock is likely to perform in line with market averages.

Related News:

Shaw Communications Posts Better-Than-Expected Q3 Results

XPeng Prices Global Offering, Expects to Raise HK$14B

Micron Reports Strong Q3 Earnings, Sells Utah Factory