PDS Biotechnology (NASDAQ:PDSB) gained about 24% in yesterday’s trading session and hit a new 52-week high of $11.48 mid-day. The positive data from an ongoing National Cancer Institute-led Phase 2 trial of the company’s PDS0101-based triple combination therapy supported the rally. The therapy will be used to treat advanced human papillomavirus (HPV)-positive cancers.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

PDS Biotech reported that the median overall survival (OS) was 21 months in 29 checkpoint inhibitor refractory patients who were given the triple combination.

Regarding the other group of patients, the company stated that 75% of CPI naive subjects continued to survive at a median follow-up of 27 months. Thus, the median OS could not be reached. Per PDS Biotech, historically, the median OS for similar patients is 7–11 months.

Based on the positive data so far, the company is planning to meet with the U.S. Food and Drug Administration to “discuss the registrational pathway.”

PDS Biotech is a clinical-stage biopharmaceutical company developing cancer immunotherapies and infectious disease vaccines.

Is PDSB Stock a Buy?

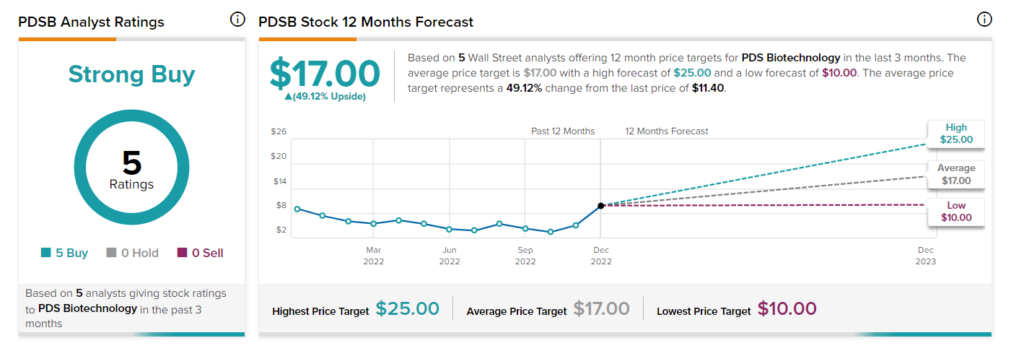

Turning to Wall Street, analysts are optimistic about PDS Biotech stock and have a Strong Buy consensus rating based on five unanimous Buys. PDSB’s average price target of $17 implies 49.1% upside potential. Over the past six months, the stock has rallied more than 200%.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.