Parkland Corporation (TSE: PKI), a distributor of fuels and lubricants, is selling off today after updating investors about its Q3-2022 expectations. What investors didn’t like is that the company’s Q3 results will come in below the company’s forecasts. The business was affected by the worsening economy and volatility in product prices. However, Parkland is optimistic about Q4 and expects Adjusted EBITDA for the full year to be within its guidance of C$1.6 billion to C$1.7 billion. Meanwhile, its Q3 Adjusted EBITDA is expected to be ~C$325 million.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

In Q3, both its Canada and USA operations were affected by falling prices. Lower market prices caused C$65 million in non-recurring losses regarding inventory and risk management in the USA segment, while lower product prices in the Canada segment caused fuel margins to fall compared to last year.

The Refining segment saw a ~55% capture of refining crack spreads, lower than before due to higher costs and higher trailing crude prices while the market was declining. However, in Q4, the company expects its refining crack spread capture rate to rise and be closer to historical rates. According to Investopedia, a crack spread is defined as “the overall pricing difference between a barrel of crude oil and the petroleum products refined from.”

In addition to updating investors about its financials, Parkland also consolidated its International segment, and its Q3 and full-year Adjusted EBITDA estimates account for this consolidation as of August 4, 2022.

Is Parkland a Good Stock a Buy?

According to analysts, Parkland is a good stock to buy. Parkland stock has a Strong Buy consensus rating based on five unanimous Buy ratings assigned in the past three months. The average PKI stock price target C$44.20 implies 62.9% upside potential.

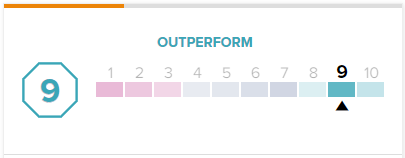

Additionally, Parkland stock has a 9 out of 10 Smart Score on TipRanks, implying that the stock has a solid chance of outperforming the market, going forward.

Conclusion: Parkland’s Q3-2022 Update Disappointed Investors

Parkland’s relatively weak business update didn’t please investors. As a result, the stock is down about 8% on the day, and at one point, the stock was down over 13%. Nonetheless, the company expects better results in Q4, and analysts are still very bullish on the stock, expecting high upside potential.