On August 1, Artal International S.C.A and Raymond Debbane bought shares of Lexicon Pharmaceuticals, Inc. (Nasdaq: LXRX) worth $42.9 million. This attracted investors’ attention and the biopharmaceutical company’s shares rose about 7.6% in Monday’s extended trading session.

As per an SEC filing, Artal International S.C.A, an affiliate of Invus, L.P., lapped up 16,173,800 shares of Lexicon at $2.5 per share. Meanwhile, Raymond Debbane, a Director of Lexicon Pharmaceuticals, purchased 982,600 shares of the company at $2.5 per share. Debbane is also the President and Chief Executive Officer of The lnvus Group, LLC, which is Lexicon’s largest shareholder.

It is worth noting that on July 28 Lexicon announced its plans to sell 17,156,400 shares of its common stock in a concurrent private offering at $2.50 per share to one or more affiliates of Invus, L.P.

Lexicon had also informed its stakeholders about the pricing of a public offering on July 28. The offering included 16,843,600 shares of common stock at $2.5 per share, before underwriting discounts and commissions.

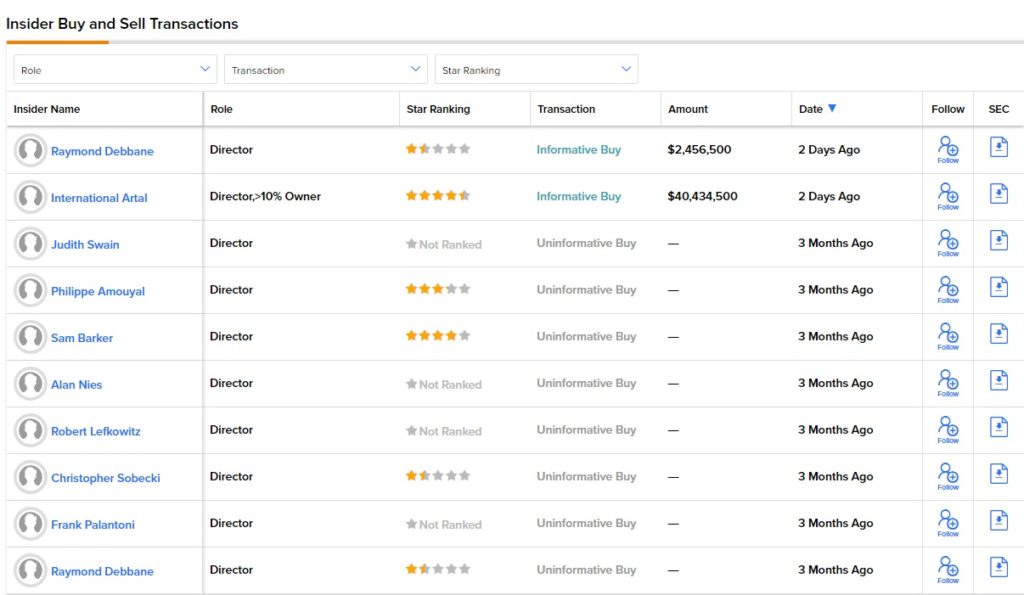

According to TipRanks, which also provides a comprehensive list of daily insider transactions, various corporate insiders have conducted uninformative Buy transactions of LXRX stock over the last three months. A pictorial representation of these transactions is provided below:

Notably, corporate insiders bought LXRX shares worth $42.9 million in the last three months.

Interestingly, TipRanks also provides a list of hot stocks that boasts of either a Very Positive or Positive insider confidence signal.

Street Has a Moderate Buy Rating on LXRX Stock

Overall, the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on one Buy and one Hold. Lexicon’s average price forecast of $20 signals that the stock may surge nearly 743.9% from current levels. Shares of the company have declined 39.1% so far this year.

TipRanks data shows that hedge funds are Very Positive about the company, as they bought 197,400 shares of LXRX in the last quarter.

Is LXRX Stock Worth a Shot?

The recent privately raised funding will allow LXRX to conduct pre and post-commercial launch activities for sotagliflozin, a drug for the treatment of heart failure and type 1 diabetes. The biopharmaceutical company will also use the proceeds from the offering to develop LX9211 to treat neuropathic pain. Finally, LXRX stock could be a lucrative investment option, as it has upside potential of 743.9%.

Read full Disclosure.