D.R. Horton (NYSE:DHI) recently received a downgrade from Raymond James, as analyst Buck Horne has lowered his expectations on homebuilders, citing high mortgage rates and a hawkish Federal Reserve.

Indeed, he also states that the monthly cost of a median-priced home is nearly 42% of a median family’s gross income. This is actually higher than the 40% seen during the 2006 housing peak.

Is DHI Stock a Buy?

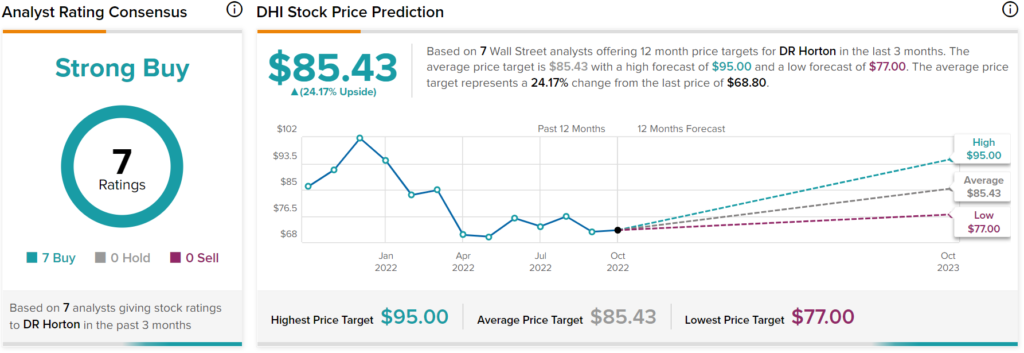

Although Buck Thorne downgraded multiple homebuilders, D.R. Horton still received an outperform rating, whereas the others have a market perform rating. This is despite the fact that he cut its 2023 EPS estimates the most, going from $15.50 per share to $4.85 per share. Overall, DHI stock has a Strong Buy consensus rating based on seven Buys assigned in the past three months. The average DHI stock price target of $85.43 implies 24.2% upside potential.