Chevron Corporation (NYSE: CVX) and the Egyptian Gas Holding Company (EGAS) signed a memorandum of understanding (MoU) on Monday in the presence of Egypt’s Minister of Petroleum and Mineral Resources, Tarek El Molla.

According to the MoU signed, both Chevron and EGAS will extend their support in building an infrastructure that will safely transport natural gas (both import and export) from the eastern Mediterranean region to Egypt. Also, the two parties will use their talents and technologies in the liquefaction of natural gas.

The cooperation agreement was discussed at length by Tarek El Molla and the Chairman of the Board and CEO of Chevron, Mike Wirth. The Egyptian minister also hinted at possible investment options in the Mediterranean region. Meanwhile, Chevron’s officials talked about the company’s aim of expanding in Egypt.

Notably, Chevron will start working on its maiden exploratory well in September this year.

Chevron’s Exposure in Egypt

The $291.5-billion company has a solid presence in Egypt, mainly engaging in exploration and production activities. The Egyptian business is part of the company’s operations in Africa. In 2021, Chevron’s production of oil and natural gas totaled 334,000 barrels per day, representing an increase of 2.1% year-over-year.

In Egypt, the company’s Mediterranean exposure includes the Nargis block, Block 4 in North El Dabaa, Block 2 in North Sidi Barrani, Block 7 in North Cleopatra, and Block 6 in North Marina. Furthermore, Chevron has a presence in Block 1 in the Red Sea.

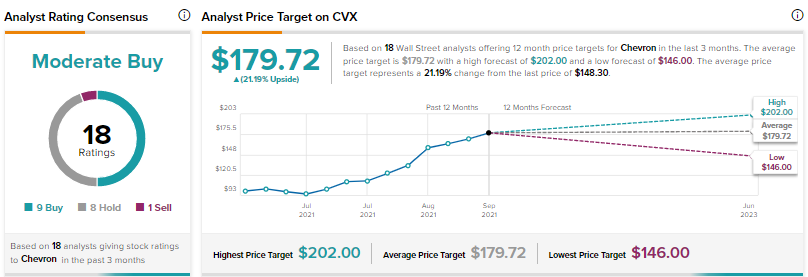

Stock Rating

On TipRanks, Chevron has a Moderate Buy consensus rating based on nine Buys, eight Holds, and one Sell. Chevron’s price forecast of $179.72 suggests a 21.19% upside potential from current levels. Over the past year, shares of CVX have increased 39.9%.

A few days ago, Jeanine Wai of Barclays reiterated a Buy rating on CVX while increasing the price target to $196 (32.17% upside potential) from $183.

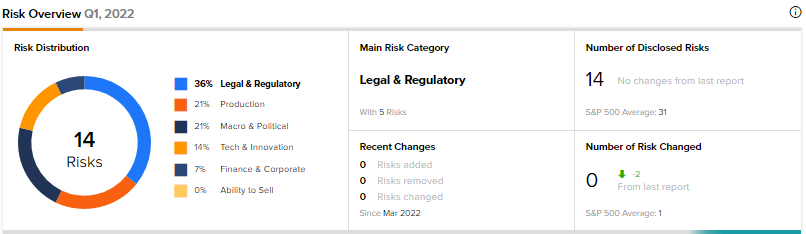

Risk Analysis

As per the TipRanks tool, Chevron’s main risk categories are Legal & Regulatory, Production, and Macro & Political. While Legal & Regulatory accounts for five of the total 14 risks identified for the stock, Production and Macro & Political add three risks each.

Conclusion

The U.S. oil & gas behemoth’s strides in expanding its footholds in the Mediterranean region and Egypt are appreciable. Its engagement in liquefying natural gas is also reflective of its commitment to boosting the supply of low-carbon energy.