Shares of technology company Avaya Holdings Corp. (NYSE: AVYA) plunged 57% on Friday after it reported preliminary results for the fiscal third quarter (ended June 30) and announced the ouster of CEO Jim Chirico.

Meanwhile, Avaya has also lowered its projections for the third quarter. The company now expects revenues between $575 million and $580 million, compared to the previous guidance of $685 million and $700 million. It expects adjusted EBITDA to be around $50 million to $55 million against $140 million to $150 million anticipated earlier.

The North Carolina-based company also anticipates a significant goodwill impairment charge during the quarter. Impairment charges are costs that reflect a decline in the carrying value of any particular asset on a balance sheet.

Further, the company plans to initiate cost-cutting measures that will impact discretionary as well as selling, general, and administrative expenses. From the first quarter of Fiscal 2023, Avaya expects to generate annual cost synergies of $225 million to $250 million.

Avaya Removes Jim Chirico as CEO

The cloud communications company has removed Jim Chirico as its President and CEO, effective August 1. Chirico has resigned from the Board but will remain with Avaya until August 16 to ensure a smooth transition. He will leave the company after almost 15 years of service.

Alan Masarek has been named the new President and CEO. He has also been appointed to Avaya’s Board. Masarek joins Avaya from Vonage Holdings Corp., where he was the CEO.

Wall Street’s Reaction

Commenting on the guidance cut, a Cowen (NASDAQ: COWN) analyst said, “The news is particularly surprising given the company completed a $600 million capital raise less than four weeks ago.”

“The company also announced the removal of its CEO, effective August 1, and an operational restructuring designed to save $225 million – $250 million per annum beginning FY23. These look like prudent steps, but we fear it may be too late to accomplish much without radically restructuring Avaya’s balance sheet,” the analyst added.

Additionally, George Sutton of Craig-Hallum downgraded the rating on the stock to Hold from Buy but did not provide a price target.

Overall, Avaya has a Moderate Sell consensus rating based on one Buy, three Holds, and three Sells. AVYA’s average price target of $4.21 implies 368.5% upside potential.

Investors Are Positive about Avaya

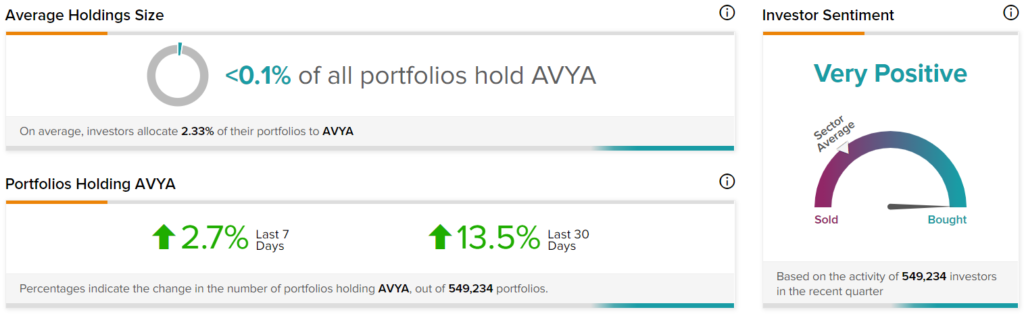

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on AVYA, with 13.5% of investors on TipRanks increasing their exposure to the stock over the past 30 days.

What’s Ahead for Avaya?

Avaya is scheduled to release its third-quarter results before the market opens on August 9. The Street expects earnings to come in at $0.38 per share, lower than the year-ago figure of $0.75 per share. Investors should wait for the results to find out more about the company’s future plans.

Read full Disclosure