Yesterday, Qiming U.S. Healthcare Fund II, L.P., a more than 10% owner of Jasper Therapeutics (NASDAQ:JSPR), bought shares of the company worth $4 million. This attracted investors’ attention, and JSPR stock rose about 8% in Tuesday’s after-trade and another 13% at the time of writing.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Jasper is a clinical-stage biotechnology company focused on enabling cures through hematopoietic stem cell therapy.

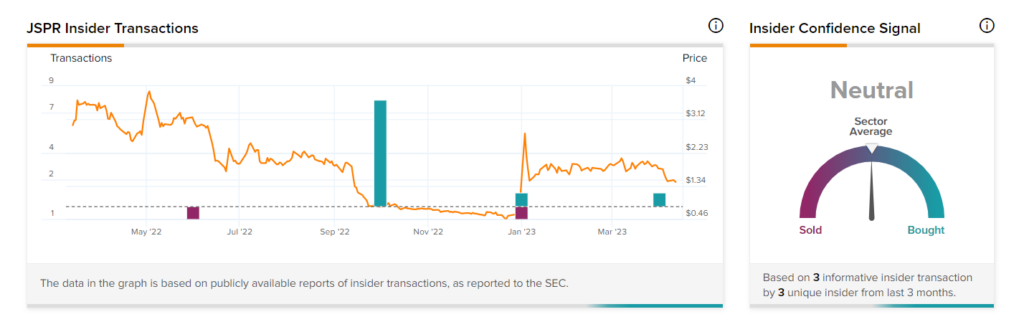

Going by the SEC filing, the venture capital fund bought 2.67 million shares of Jasper at a weighted average price of $1.5 per share on January 27, 2023. The transaction forms part of Jasper’s underwritten public offering of 60 million shares of its common stock at a price of $1.50 per share.

As per the data collected by TipRanks, the fund has a 50% success rate with an average return of 7.6% per transaction over the past month.

Overall, corporate insiders have bought JSPR shares worth $8.6 million over the last three months. TipRanks’ Insider Trading Activity Tool shows that insider confidence in Jasper stock is currently Neutral.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is Jasper a Good Stock to Buy?

Currently, Wall Street is optimistic about JSPR stock. It has a Strong Buy consensus rating based on four unanimous Buy recommendations. The average stock price target of $6.21 implies an impressive upside potential of 328.3%.