Yesterday, Energy Transfer (ET) Director Kelcy Warren bought 1.159 million ET shares at $10.93 per share for a total value of $12.67 million. The move comes after the company’s recent Q2 outperformance and a dividend hike.

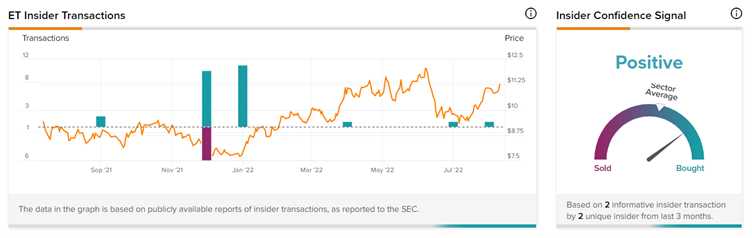

TipRanks’ Insider Trading Tool shows Insiders at Energy Transfer are clearly optimistic about the stock’s near-term prospects and have bought ET stock worth a whopping $14 million in the last three months.

The tool also shows that Insider Confidence Signal is currently Positive for Energy Transfer, with corporate insiders heftily buying ET stock recently.

Interestingly, TipRanks also provides a list of hot stocks that boasts either a Very Positive or Positive insider confidence signal.

What Does Energy Transfer Company Do?

Headquartered in Dallas, Energy Transfer is the provider of natural gas pipeline transportation and transmission services. It is one of the largest and most diversified midstream energy companies in the U.S., with approximately 120,000 miles of pipelines and associated energy infrastructure across 41 states transporting oil and gas products.

We will now take a deeper look at the recent events at the company that could have further sparked insider interest in the stock.

Last week, Energy Transfer reported upbeat Q2 results, topping both earnings (by two cents) and revenues (by an impressive $5.57 billion) consensus estimates.

Furthermore, last month, Energy Transfer hiked its quarterly dividend by 15% to $0.23 per share. The dividend now reflects an impressive dividend yield of 6.5%.

Backed by robust demand, the company has also raised its full-year guidance. It now forecasts adjusted EBITDA to range between $12.6 and $12.8 billion, compared to its prior outlook of $12.2 and $12.6 billion.

Is ET a Buy Right Now?

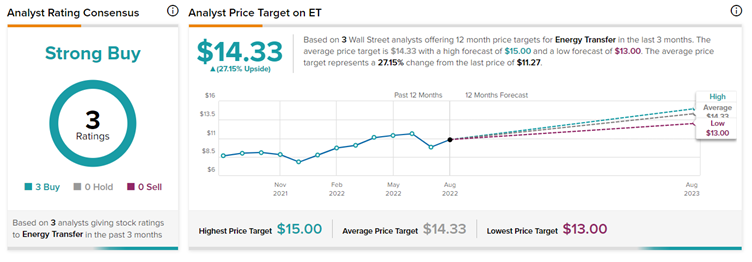

The Wall Street community is clearly optimistic about the stock. Overall, the stock commands a Strong Buy consensus rating based on three unanimous Buys. Energy Transfer’s average price target of $14.33 implies 27.15% upside potential from current levels.

Further, ET stock boasts a score of 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Final Thoughts

Shares of Energy Transfer have significantly outperformed its benchmark index. While ET stock has gained about 30% year-to-date, the S&P 500 is down more than 12%.

Given the burgeoning demand for energy and the sky-high oil and gas prices, Energy Transfer could continue to outperform the market.

Read full Disclosure