Following the announcement that the President and CEO of Gap, Inc. (NYSE: GPS), Sonia Syngal, will step down, shares of the company declined 3.4% in the extended trading session on Monday. The fall continued, and the stock was trading 6.6% down in the pre-market trading session on Tuesday. Syngal will also resign from the company’s board.

Syngal joined the apparel retailer in 2004 as the CEO of the Old Navy brand. She became Gap’s CEO in March 2020.

Until the company finds a permanent replacement for Syngal, Executive Chairman Bob Martin will serve as the Interim CEO and President of Gap. Martin has been on the company’s board since 2002 and was named the Executive Chairman in 2020.

Meanwhile, Horacio Barbeito has been named the President and CEO of the Old Navy brand, effective August 1. Barbeito will join Gap from Walmart (NYSE: WMT) Canada, where he served as the President and CEO.

Commenting on the development, Morningstar analyst David Swartz said, “I think it’s a necessary change given Gap’s recent problems. The addition of a permanent CEO for Old Navy is positive as Gap needs to stabilize this part of the business.”

The Managing Director of research firm GlobalData, Neil Saunders, said, “Initiatives have been piecemeal rather than part of a coherent grand plan of reinvigoration. The result is a company that in its core businesses still suffers from many of the same issues that have dogged it for years.”

Gap Updates Its Q2 Outlook

For the second quarter, the San Francisco-based company expects net sales to witness a year-over-year decline in the high-single-digit range and adjusted operating margin to be negative.

Further, it anticipates to record transitory incremental air freight expenses and inflationary costs of around $50 million. Gap expects its gross margin to take a hit, triggered by discounts and promotions that were introduced to get rid of its unsold Old Navy stock.

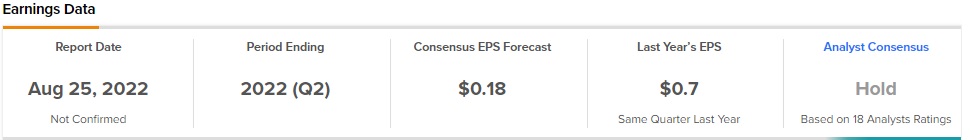

The company is scheduled to announce its second-quarter results on August 25. The Street expects earnings of $0.18 per share, lower than $0.70 reported last year.

It posted a loss of $0.44 per share in the first quarter, compared to analysts’ expectation of a loss of $0.15 per share and the year-ago profit of $0.48 per share. Net sales decreased 13% year-over-year to $3.5 billion.

Wall Street Says Mind the Gap

On TipRanks, the stock has a Hold consensus rating based on three Buys, nine Holds and six Sells. Gap’s average price target of $11.71 implies 33.7% upside potential from current levels.

Surprisingly, TipRanks shows that financial bloggers are 92% Bullish on the stock, compared to the sector average of 63%.

Why Is Gap Such a Damsel in Distress?

Gap’s sales have been falling for years and recently its plan to revive the Old Navy brand backfired — when it launched more sizes to expand its customer base. The casual clothing company fell short of medium-sized clothes and was stuck with either very large or very small sizes. This also became a major setback for Gap, as the brand generates over 50% of the company’s total revenues.

Read full Disclosure