California-based biotech Amgen (AMGN) boasts a recently FDA-approved drug called Lumakras, which was designed to treat adult patients with non-small cell lung cancer (NSCLC).

“As we look to the balance of the year, we are excited to be launching LUMAKRAS, a first-in-class lung cancer treatment,” said Amgen CEO Robert Bradway in the second-quarter report.

Let’s take a look at Amgen’s financial results and risk factors.

Amgen’s Q2 Financial Results and 2021 Outlook

The company reported its second-quarter financial results on August 3. Revenue increased 5% year-over-year to $6.5 billion. Meanwhile, adjusted EPS came in at $4.38, marking an increase of 4% year-over-year.

Additionally, Amgen distributed a dividend of $1.76 per share and repurchased shares worth $1.6 billion during Q2. Notably, the company closed the quarter with cash and investments valued at $8.1 billion and $32.8 billion in debt.

Amgen anticipates full-year 2021 revenue to be in the range of $25.8 billion-$26.6 billion. Additionally, it expects adjusted EPS to be in the range of $16-$17. (See Amgen stock charts on TipRanks)

Amgen’s Risk Factors

According to the new TipRanks Risk Factors tool, Amgen now carries 29 risks, up from 27 previously. The top risk category is the Ability to Sell, accounting for 28% of the total risks. Legal and Regulatory and Macro and Political are the next two major risk categories at 21% and 17%, respectively.

Since June, Amgen has introduced two new risk factors. A newly added risk under the Ability to Sell category cautions that Amgen’s sales and profitability may be adversely affected by changes in the coverage and reimbursement of the U.S. federal government’s healthcare programs.

In addition, a newly added risk factor under the Macro and Political category tells investors that measures to combat the COVID-19 pandemic will continue to adversely affect Amgen’s operations. Notably, the company highlights the adverse impacts on its clinical trials, supply chain, and product sales.

Analysts’ Take

Following Amgen’s Q2 earnings release, Piper Sandler analyst Christopher Raymond reiterated a Buy rating with a price target of $255. Raymond’s price target suggests 8.98% upside potential.

The analyst notes that Amgen’s Q2 results were “good enough” to avoid another sell-off, which was experienced following last quarter’s results.

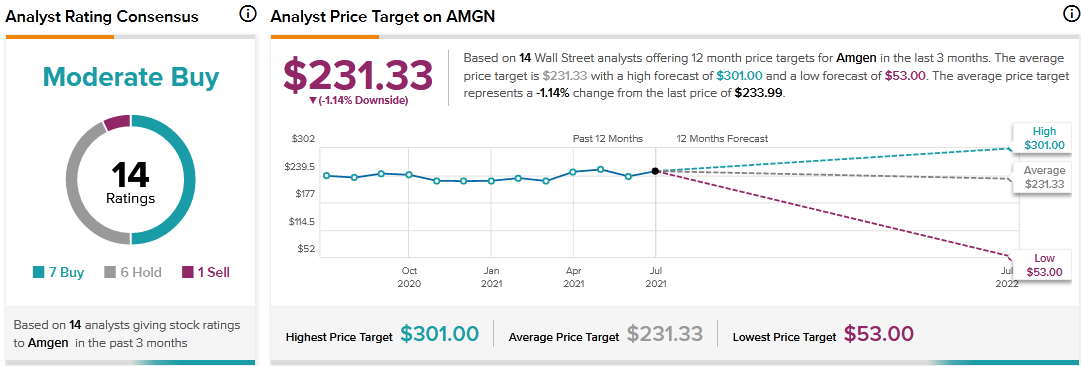

The consensus rating is a Moderate Buy based on 7 Buys, 6 Holds, and 1 Sell. The average Amgen price target of $231.33 implies 1.14% downside potential to current levels.

Related News:

What Does T-Mobile’s Newly Added Risk Factor Reveal?

What Investors Can Learn from Fortinet’s New Risk Factors

Kraft Heinz Reports Quarterly Beat; Shares Fall 5%