Amazon’s (AMZN) private-label business may no longer be the source of the excitement that Jeff Bezos may have sought in pushing to expand it rapidly. The company is weighing its options for the business, including ditching it entirely.

Amazon’s retail platform is generally a place for outside merchants to sell their items to online shoppers. They pay Amazon for the opportunity to set up digital shops on its platform. At some point, however, Amazon decided it would also sell its own brand-name products.

The business started in 2009 with only a handful of products, but has grown rapidly in recent years to more than 240,000 products spanning dozens of brands. However, all is not well anymore and Amazon is reviewing its options for the unit.

The Latest on Amazon’s Private-Label Business

According to a Wall Street Journal report, Amazon’s private-label sales have been disappointing, and the company is now considering scaling back or ditching the business altogether. If it decides to shrink the business but continue with it, Amazon may narrow its focus to best-selling items only, according to the report.

While Amazon may eventually decide to ditch the private-label business, the company says that it is not seriously considering the same. The Amazon executive who initiated a relook at the private-label business left the company recently.

The unit launched with only a limited number of items, mostly consumer electronics. It has since expanded to include everything from fashion items to furniture and food products.

However, the unit only accounts for about 1% of Amazon’s retail sales, which surpassed $241 billion in 2021. The private-label business has a powerful ally in Amazon founder Jeff Bezos, who pushed it to account for 10% of sales, according to the report. Still, the private-label business has been a source of tension between Amazon and its third-party merchants. The sellers have complained against Amazon over what they see as unfair business practices.

Wall Street Is Strongly Bullish about AMZN

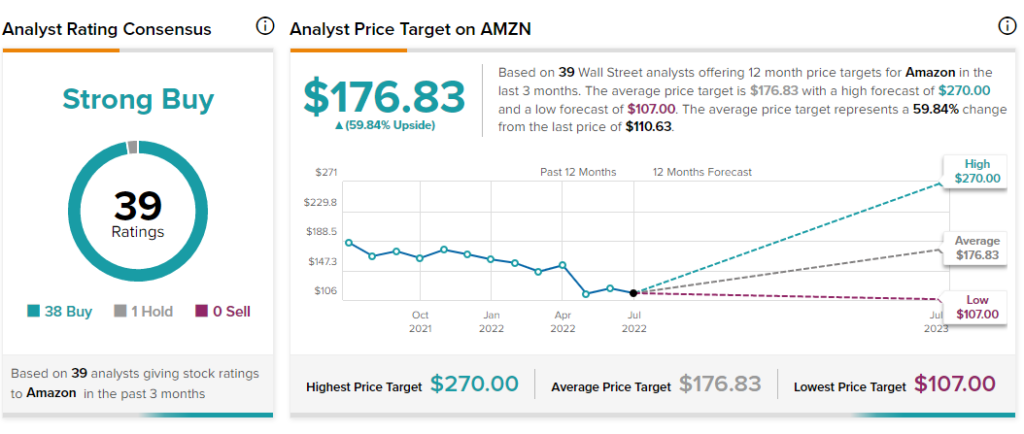

On July 14, Cowen & Co. analyst John Blackledge reiterated a Buy rating on Amazon stock with a price target of $210, which indicates nearly 90% upside potential. Although the analyst cut the price target from $215 previously, he believes the stock is cheap at current levels.

Consensus among analysts is a Strong Buy, based on 38 Buys and one Hold. The average Amazon price forecast of $176.83 implies upside potential of almost 60% to current levels. Shares have declined 35% year-to-date amid the broad selloff in stocks.

AMZN Stock to Outperform

Amazon scores a nine out of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Key Takeaway for Investors

In attempting to build the private-label business rapidly, Amazon may have realized that the venture could be lucrative. However, circumstances may have changed now. Shrinking the business or ditching it entirely may allow Amazon some breathing space to focus on being more profitable. The company may also avoid some criticism from its third-party sellers.

However, a diminished or nonexistent private brand unit could hurt interest in Amazon’s Prime membership program, which has been an important fuel for retail sales.

Read full Disclosure.