Heico Corp. reported better-than-expected results in the fourth quarter. Meanwhile, the manufacturer of aerospace, defense, and electronic products saw its earnings and revenues decline year-over-year due to the negative impact of the COVID-19 pandemic.

Heico’s (HEI) 4Q earnings of $0.45 per share fell 27.4% year-over-year but came ahead of the Street’s estimates of $0.41. The company’s 4Q revenues of $426.2 million beat the consensus estimates of $414.8 million but dropped 21.3% from the year-ago quarter.

Heico’s CEO Laurans A. Mendelson said, “Our consolidated fiscal 2020 operating results were significantly affected by the COVID-19 global pandemic.” He further said, “Most notably, the commercial aerospace industry experienced an ongoing substantial decline in demand resulting from a significant number of aircraft in the global fleet being grounded during fiscal 2020.”

Looking ahead, Mendelson said, “we believe our ongoing fiscal conservative policies, healthy balance sheet and increased liquidity will permit us to invest in new research and development and gain market share as the industry recovers.”

Mendelson added that he anticipates a gradual recovery in demand for the company’s commercial aerospace parts and services products in fiscal 2021 following the recent progress in COVID-19 vaccine approvals which he hopes will boost commercial air travel. (See HEI stock analysis on TipRanks).

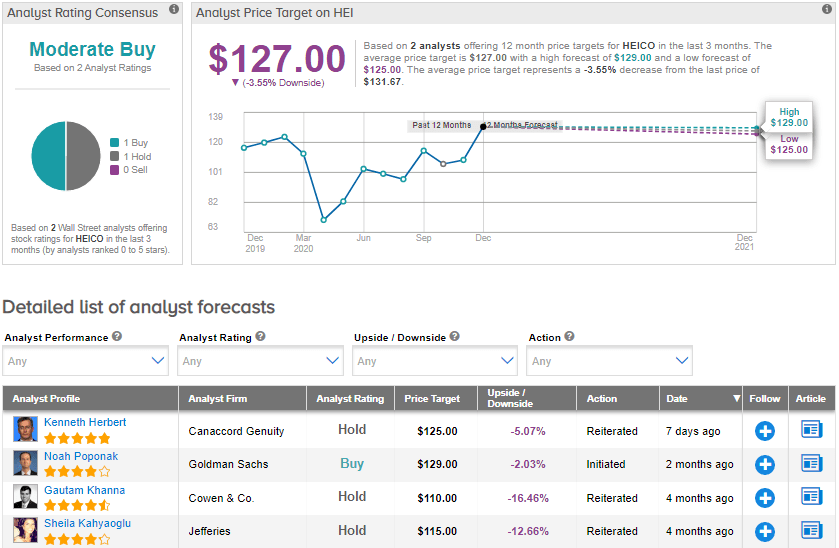

Following the 4Q results, Cowen & Co. analyst Gautam Khanna maintained a Hold rating and a price target of $110 (16.5% downside potential) on the stock. He said, “HEI did not give initial 2021 guidance. Management expects to invest in incremental R&D & gain market share, and for the comml aero [commercial aerospace] market to gradually recover in FY21.”

Currently, the Street has a cautiously optimistic outlook on the stock with a Moderate Buy analyst consensus. The average price target stands at $127 and implies downside potential of about 3.6% to current levels. Shares have increased 15.4% year-to-date.

Related News:

FactSet Beats 1Q Estimates But No Change In 2021 Outlook; Top Analyst Says Sell

Calavo Sinks 16% As 1Q Sales Outlook Lags Street Estimates

Progressive’s Profit Soars 142% in November; Analyst Lifts PT