Shares of Hasbro, Inc. (HAS) popped 3.2% after the company delivered robust third-quarter results beating both earnings and revenue estimates aided by a diversified business model. Shares closed at $91.36 on October 26.

Hasbro is a provider of children and family leisure time products and services with a portfolio of brands and entertainment properties. With a market cap of $12.18 billion, shares have gained 7.4% over the past year.

The company reported adjusted earnings of $1.96 per share, up 4% year-over-year and significantly better than analyst estimates of $1.70 per share. (See Insiders’ Hot Stocks on TipRanks)

To add to that, revenue grew 11% year-over-year to $1.97 billion and also surpassed Street estimates of $1.96 billion. Revenue from Hasbro’s Entertainment segment increased 76%, and the Wizards of the Coast and Digital Gaming segment’s revenue grew 32% compared to the prior-year quarter. The Consumer Products segment, its major revenue contributor, saw a decline of 3% due to global supply chain challenges.

Commenting on the results, Deborah Thomas, CEO of Hasbro said, “The strength of the business is evident in the quarter’s results, highlighting the benefits of our Brand Blueprint strategy to deliver strong revenue, earnings, and cash flow… We are also working tirelessly to ensure product for the holiday, and are pleased that, through today, we have delivered much of what was delayed in the third quarter despite continued supply chain challenges.”

Despite witnessing a huge surge in orders, the company warns of supply chain constraints that could hamper its ability to satisfy them completely. Based on the current economic environment and business momentum, Hasbro guided for full-year 2021 revenue growth of 13% – 16% and operating margins of around 15%.

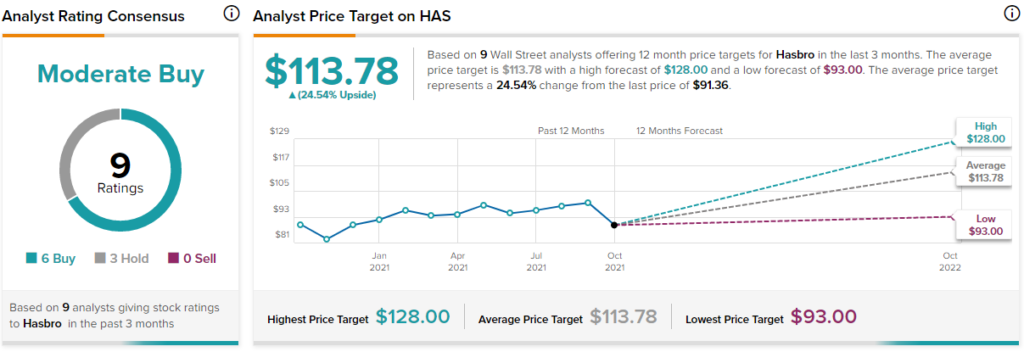

Yesterday, BMO Capital analyst Gerrick Johnson maintained a Hold rating on the stock with a price target of $93, implying 1.8% upside potential to current levels.

Johnson said, “We think HAS’ ability to supply retailers in its consumer products business has been amongst the weakest of the toy companies we cover. This is not unknown by investors, as is evident by the stock’s recent weakness. Management had previously commented that some 3Q shipments would slip into 4Q.”

Johnson had expected Hasbro to report adjusted earnings of $1.47 per share on revenue of $1.88 billion.

Overall, the stock has a Moderate Buy consensus rating based on 6 Buys and 3 Holds. The average Hasbro price target of $113.78 implies 24.5% upside potential to current levels.

Related News:

Brown & Brown Exceeds Q3 Expectations; Shares Jump 2.5% After-Hours

Lennox Falls 2.5% on Disappointing Q3 Results

RenaissanceRe Posts Wider-Than-Expected Q3 Loss