The Hartford Financial Services Group authorized a new share buyback program worth $1.5 billion. The investment and insurance company said that the new program will be effective from Jan. 1, 2021 to Dec. 31, 2022.

Hartford Financial (HIG) will start buying back shares after reporting 4Q earnings results.

Following the share buyback announcement, Wells Fargo analyst Elyse Greenspan maintained a Buy rating and a price target of $50 (6.9% upside potential) on the stock. The analyst said, “We think the shares should respond favorably to the announcement, which confirms they will be back repurchasing their shares in early 2021. We expect this authorization is about in line with consensus expectations.”

Greenspan further added, “We think the company’s valuation (trading right at book value and at only 8.3x 2021 earnings) is not giving it credit for its strong underlying businesses, especially within commercial lines as we are in a hard commercial lines market (in the majority of business lines excluding workers’ compensation) and is discounting the stock for potential Covid-19 business interruption losses that we do not think will materialize.” (See HIG stock analysis on TipRanks)

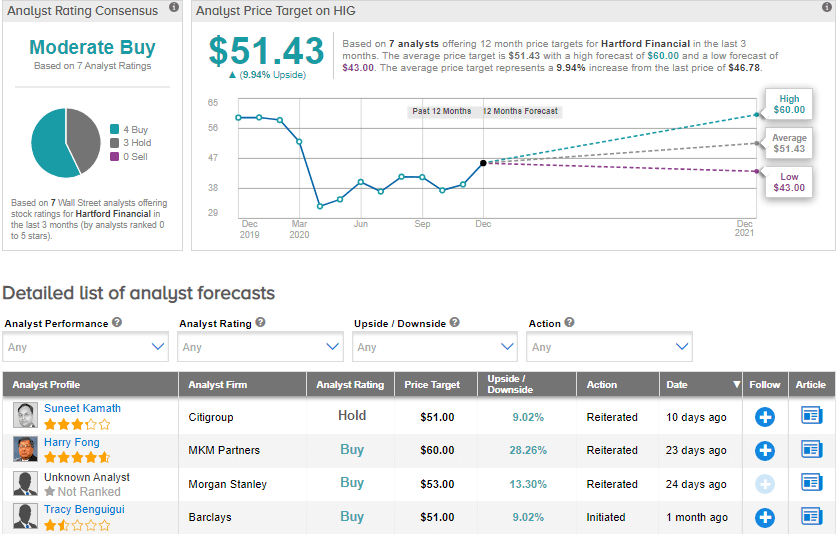

Meanwhile, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 4 Buys and 3 Holds. The average price target stands at $51.43 and implies upside potential of about 9.9% to current levels. Shares declined about 23% year-to-date.

Related News:

AutoZone Board Approves $1.5B Share Buyback Plan; Street Is Bullish

Ollie’s Bargain Boosts Share Repurchase Plan By $100M

Waste Management Announces 5.5% Dividend Hike, New Share Repurchase Plan