Ahead of every earnings season I like to take a look at the names with the biggest revisions since the last quarter, as it always provides an interesting snapshot of what analysts are expecting, and how those expectations have adjusted overtime and in changing economic conditions. Whether or not earnings momentum as an investment strategy is a winning one is up for debate, especially as research shows that since the great recession earnings momentum doesn’t necessarily hold for multiple quarters as it did prior to that period. For our purposes, however, we’re just trying to take the temperature for Q2, and increasing consensus estimates are a good sign for any stock in the short-term.

Below I’ve screened for companies with the largest increases in Wall Street EPS consensus since last quarter. This data tends to reveal not just individual names that are anticipated to do well, but a concentration of winning industries; as you’ll see the Q2 data did settle around a few key groups. This started as a top 10 list that morphed into a top 13 list in order to include names that fell into one of the relevant sub-sectors. Note that small and microcaps were excluded.

Guns

#1 Smith & Wesson (SWBI) – EPS consensus increased 764% in the last 3 months

#11 Sturm Ruger (RGR) – EPS consensus increased 127% in the last 3 months

Firearms tend to do well in election years due to the possibility of increased regulation if a Democrat is elected, and this year is no different. Background checks hit an all time high in June of 3.9M, beating the previous record of 3.7M in March. Analysts expect this surge to continue through the fall.

Lake Street analyst, Mark Smith, who has a 4.5 star rating TipRanks, said in a recent note that the latest run in gun manufacturers stock prices likely has to do with “unfilled demand from Covid, recent buying due to civil unrest and continued and perhaps heightened buying due to the upcoming election and potential for increased regulation following the election.” Last month he reiterated his Buy rating for SWBI, and increased his price target to $24.00 from $19.00, 11.3% upside from current prices. His RGR Buy rating was reiterated Wednesday, with a PT of $92.00 (20% upside).

Gaming

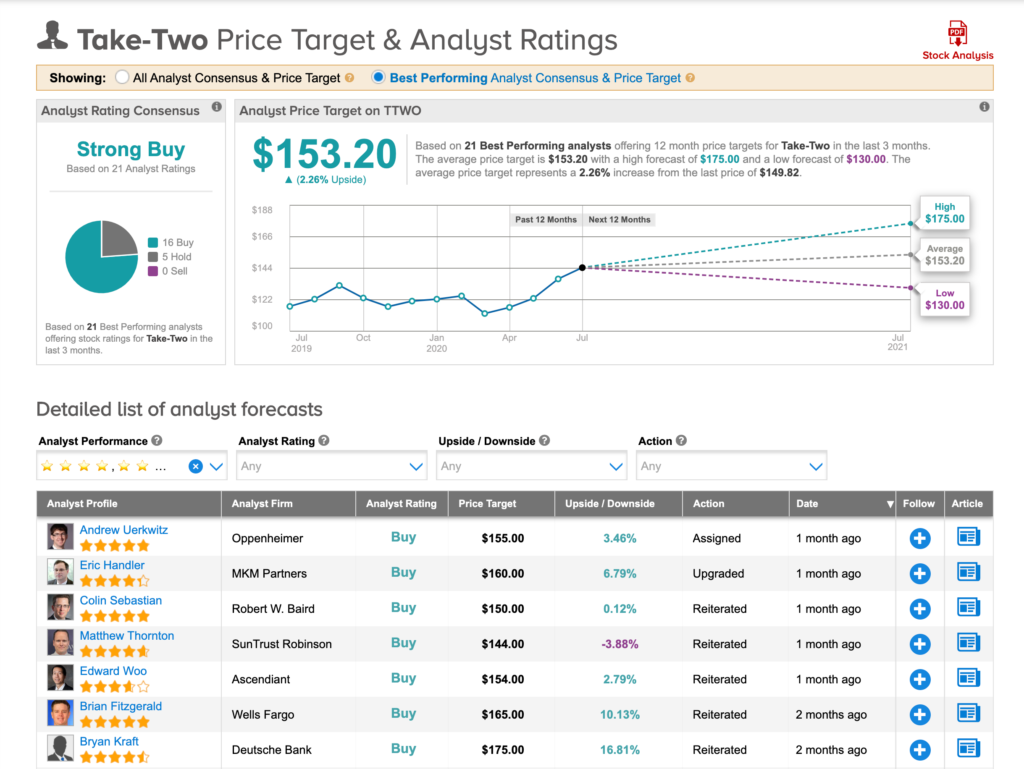

#6 Take-Two (TTWO) – EPS consensus increased 252% in the last 3 months

#8 Glu Mobile (GLUU) – EPS consensus increased 152% in the last 3 months

#12 Electronic Arts (EA) – EPS consensus increased 116% in the last 3 months

#13 Activision Blizzard (ATVI) – EPS consensus increased 75% in the last 3 months

Video game makers have done increasingly well throughout the coronavirus pandemic, despite physical game sales falling, digital sales have been more than enough to offset those weaknesses. Therefore it’s not terribly surprising that Take Two, Electronic Arts, Activision Blizzard and Glu Mobile were all found in our top 13 list. Current Price Targets from the best analysts on Wall Street only suggest that they will continue trending upward. All but EA are considered Strong Buys at this time.

The highest price target on TTWO is $175, 17% above current levels. This is held by both Eric Sheridan at UBS and Bryan Kraft at Deutsche Bank, both 5-star analysts on TipRanks. In a research note last month, Kraft told investors “Take Two is the best growth story in video games.” He continued “The company is positioned to both continue leveraging its major active titles through live services growth and significantly increase its earnings power over the next few years through the release of tent pole titles based on proven intellectual property.”

Home Furnishings

#7 Williams-Sonoma (WSM) – EPS consensus increased 209% in the last 3 months

#9 Restoration Hardware (RH) – EPS consensus increased 144% in the last 3 months

#10 Wayfair (W) – EPS consensus increased 142% in the last 3 months

Analysts predicted that more time at home during coronavirus-related lockdowns would equal more interest in fixing up our homes, and that’s been true for the most part with home improvement and furnishing companies capitalizing on this trend and reporting better than expected profits in Q1.

But despite having an uptick in Q2 expectations, analysts aren’t as bullish on those stocks going forward, with WSM and W both with Hold consensus rankings by top analysts. RH is a Moderate Buy and the only one with price upside of 2.4%.

Rounding out the list

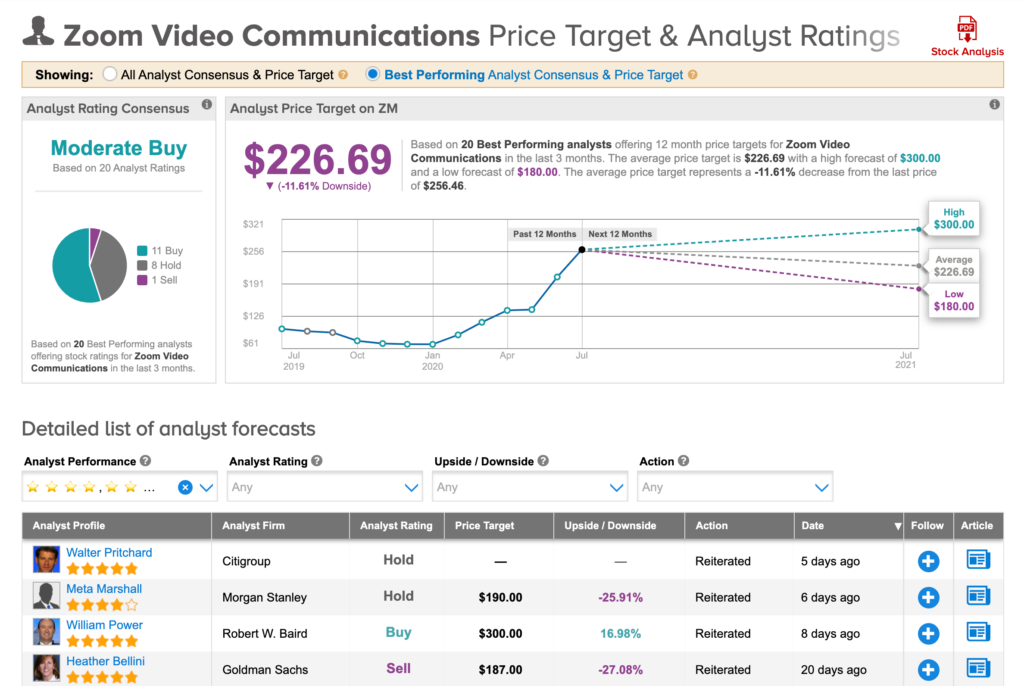

#4 Zoom Video Communications (ZM) – EPS consensus increased 323% in the last 3 months

One of everyone’s favorite stay-at-home names, taking remote meetings that could have simply been conference calls and turning them unnecessarily into a visual experience that has forced everyone to now have special “Zoom shirts” for these occasions. While they’ve dominated the virtual meeting space this year, they have stiff competition coming from the likes of Microsoft, Google, Cisco, and Facebook. ZM is up 292% this year.

Zoom currently stands as a Moderate Buy on TipRanks, based on ratings from to 20 best performing analysts that cover this name. But not all top analysts are a fan. Goldman Sachs’ analyst, Heather Bellini, raised her Price Target on ZM to $187.00 (from $156.00), but still maintained a Sell rating.

#2 Etsy (ETSY) – EPS consensus increased 706% in the last 3 months

How things can change in a year. In 2019 Etsy showed up on several “dead in the water” lists, analysts were bearish, the stock was down 10%, it wasn’t looking good for the third-party ecommerce site known for providing a platform for independent artisans. Then COVID hit, and everyone needed a facemask, but Amazon was sold out. CEO Josh Silverman in an interview with Fortune confirmed that at one time searches for “facemask” were up to 9 per second. In it’s Q1 report Etsy also revealed that in April the site sold $133M worth of masks.

Analysts are now jumping aboard the bullish train and increasing their Price Targets for the stock. Just last week, the 5 star analyst from Canaccord Genuity, Maria Ripps, raised her Price Target to $130 from $85, that’s about 28% higher from where the stock trades now.

#3 iRobot (IRBT) – EPS consensus increased 646% in the last 3 months

I admittedly got a Roomba during Covid, and I’m seemingly not alone in that purchase (ok mine was actually a gift, but the best gift ever). In a business update provided on June 15 the company described the “substantially stronger-than-expected quarterly revenue” from Q2, crediting lockdown measures “as consumers worldwide are increasingly relying on Roomba robot vacuums and Braava robot mops to address their home floor care needs.”

The top 6 analysts on TipRanks are calling this one a Moderate Buy, with a Consensus Price Target of $82.20, roughly 1.5% below where it now trades.

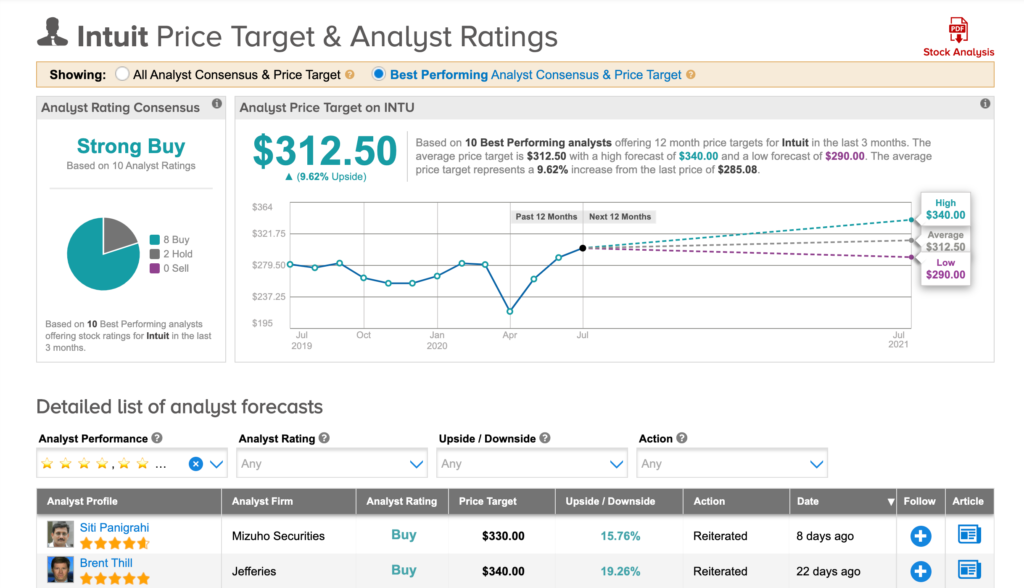

#5 Intuit (INTU) – EPS consensus increased 291% in the last 3 months

Tax season is the most wonderful time of the year for TurboTax parent Inuit, and an extension to file until July 15 only dragged out that season for the company. This earns the company a Strong Buy consensus from the top 10 analysts that cover this name.