Shares of Guess advanced 12% in Wednesday’s morning trading after the clothing retailer topped 2Q revenue of $399 million. Analysts had anticipated revenue of $385 million. The company’s 2Q loss of $0.01 per share was lower than analysts’ expectations of a loss of $0.58. Guess reported earnings of $0.38 per share in the year-ago quarter.

Guess’ (GES) revenue in 2Q declined 42% year-over-year, due to store closures and lower demand during the pandemic. Guess’ CEO Carlos Alberini said “We increased product margins, ended the period with inventories down 13% compared to last year and finished the quarter with a strong balance sheet and ample liquidity.” Alberini added that the company is “well positioned” for the second half.

Guess reinstated its quarterly dividend of $0.1125 per share, which will be paid on October 2 to shareholders of record as on Sept. 16. The company spent $39 million to buy back shares during the quarter. (See GES stock analysis on TipRanks).

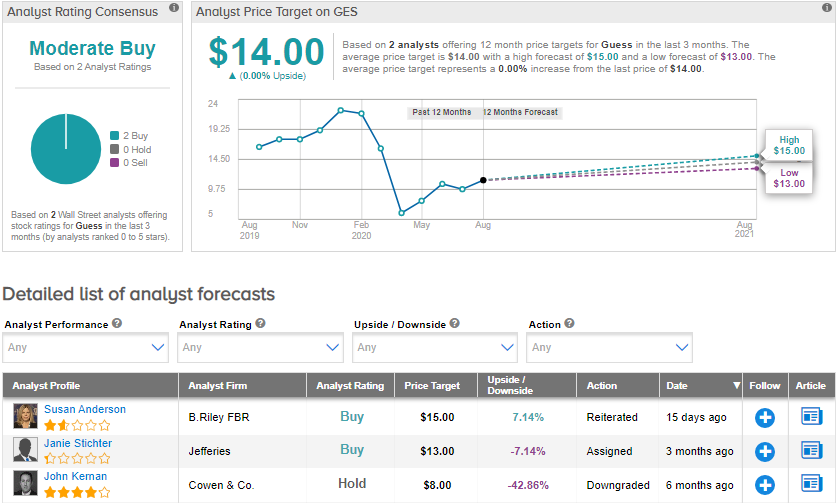

On Sept. 2, BTIG analyst Susan Anderson maintained a Buy rating on the stock and a price target of $15 (7.1% upside potential), saying that “Online clearance was +20% Y/Y this week and continues to trend higher but stabilize from early August highs.”

Currently, the Street has a cautiously optimistic outlook on the stock, with a Moderate Buy analyst consensus. The average price target of $14 implies that the shares are fully priced at current levels. Shares have dropped over 37% year-to-date.

Related News:

Gogo Pops 21% On $400M Intelsat Deal For Commercial Aviation Biz

Macy’s Pops 6% As 2Q Revenue Surprises

H&R Block Drops After 1Q Revenue Miss